China SignPost™ (洞察中国) #18–China’s New Project 718/J-20 Fighter: Development outlook and strategic implications

Gabriel B. Collins and Andrew S. Erickson, “China’s New Project 718/J-20 Fighter: Development Outlook and Strategic Implications,” China SignPost™ (洞察中国) 18 (17 January 2011).

Japanese translation now available.

China SignPost™ 洞察中国–“Clear, high-impact China analysis.”©

- China’s J-20 fighter has the potential to be a formidable air combat system in the Asia-Pacific region, but a number of technical hurdles will need to be overcome before mass production can commence.

- Key technical capabilities that we await demonstration of are thrust vectoring, sensor fusion, active electronically scanned radars, and a higher level of tanker and AWACS support. Operating a low-observable aircraft also requires major maintenance inputs.

- The Chinese aerospace industry is making rapid technical progress, but the ability to build late-generation, supercruise-capable engines issue in particular will be a key bottleneck that helps decide the J-20’s initial operational capability (IOC) date as a true stealth platform.

For the past two weeks, a series of photos and video clips showing a prototype of China’s new 5th-generation fighter aircraft have electrified defense specialists around the world. The atmosphere became particularly charged after the aircraft made a short test flight two days after U.S. Secretary of Defense Robert Gates began a visit to China on 9 January 2011. It is especially interesting that the J-20’s test flight occurred on 11 January 2011, precisely three years after its first anti-satellite (ASAT) test in 2007 and one year after its first anti-ballistic missile (ABM) test in 2010. As with those tests, China’s Foreign Ministry and other branches of government appeared to be out of synch with the People’s Liberation Army (PLA) in their initial responses to inquiries on the subject; this prompted foreign speculation about the civilian leadership’s degree of control over the military.

Chinese test aircraft (e.g., the J-15) are typically painted with a plain yellowish-green primer. The J-20, by contrast, had a military-style paint job complete with PLA insignia. Significant numbers of Chinese were able to watch parts of the test, which could have been easily prevented. According to some Chinese military websites and photos, future Chinese President Xi Jinping and fellow Politburo Standing Committee member Wu Bangguo were in Chengdu on 10 January, and Xi even entered the J-20’s cockpit. It was cloudy, however, so the test flight was cancelled. Like all other Politburo Standing Committee members, therefore, President Hu Jintao should have known that the J-20 was ready for a test flight. He probably did not know the exact time of test flight because that depended on such unpredictable factors as weather conditions.

Secretary Gates’ initial statement that President Hu was “unaware of the flight test” almost certainly means unaware it would take place on that specific date, rather unaware of the J-20’s status entirely. Considering the importance, and likely cost, of China’s fifth-generation fighter program (designated “Project 718” in what appear to be official Internet photographs), China’s senior civilian leadership would certainly be aware of its progress at least in general terms, presumably including the flight test stage was approaching. The PLA may have its own perspective and its own organizational interests, but the Party still controls the gun. Indeed, Hu himself subsequently confirmed to Gates that the test flight had indeed occurred, but assured him that the timing was coincidental. “I asked President Hu about it directly, and he said that the test had absolutely nothing to do with my visit and had been a pre-planned test,” Gates told reporters in Beijing.

China’s J-20 test thus resembles a muted strategic communication to an international audience, not a formal one that might provoke diplomatic discord in advance of President Hu Jintao’s 19 January state visit to the U.S. Jane’s quoted Chinese sources as suggesting that “China may have accelerated the schedule for the J-20’s maiden flight after the US Department of Defense (DoD) finally agreed to modernise Taiwan’s fleet of Lockheed Martin F-16A/B fighter aircraft.” Regardless of the precise intention this time, such releases of military information are increasing of late as China for the first time has world-class capabilities to show off, and engages in “selective transparency” to get credit for those capabilities—both from its domestic populace, and from potential competitor nations.

Exhibit 1: J-20 in flight

Source: Chinese Internet

That said, our analysis seeks to move beyond the timing of the J-20’s maiden flight, and instead focus on what the test suggests about China’s rapidly developing aerospace industry and what capabilities the J-20 might offer to the Chinese military.

Exhibit 2: J-20 development timeline

Source: DoD, Reuters, Wall Street Journal, Sina.com

Secretary of Defense Gates recently clarified his earlier remarks about China not having an operational 5th generation fighter until 2020, telling reporters accompanying him on his flight to Beijing on 9 January 2011: “What I said was that in 2020 or 2025 that there would still be a vast disparity in the number of deployed fifth generation aircraft that the United States had compared to anybody else in the world.”

U.S. intelligence community estimates currently anticipate the J-20 achieving initial operation capability (IOC) around 2018, according to the Wall Street Journal. VADM David Dorsett, Deputy Chief of Naval Operations for Information Dominance, told reporters on 5 January 2011 that “I think one of the things that is probably true, true from my observation in the last several years, is we have been pretty consistent in underestimating the delivery and IOC of Chinese technology, weapon systems. They’ve entered operational capability quicker...” We think there is a substantial possibility that this could happen with the J-20 as well. Admiral Dorsett added, however, that “developing a stealth capability with the prototype and then integrating that into a combat environment is going to take some time.”

China’s military aerospace complex is clearly very busy at present, working hard to develop a carrier-based fighter (J-15), build out the J-10 fleet, develop and produce transport and AWACS aircraft, and now to develop the J-20. That said, we believe that Beijing’s generous support of its increasingly skilled aerospace research & development complex, rising defense budget (officially ~US$78 billion for 2010; and probably significantly higher, according to foreign estimates, particularly if purchasing power parity is factored in), and ability to rapidly build industrial infrastructure create a very real possibility that the J-20’s IOC date comes before 2018.

Ability to move to mass production

China has sufficient financial resources that a shift toward more rapid J-20 production could begin to produce airframes quickly—if the country’s aviation industry can master high-performance jet engine production, an extremely difficult task achieved by only a handful of firms around the world, for which it has yet to demonstrate requisite capability.

To give a sense for what additional production capacity for a late-generation fighter costs, a 2010 RAND study cites a cost of between US$150 million and US$554 million to restart F-22 Raptor production after termination. We acknowledge there are significant differences between creating production capacity and restarting production of an aircraft whose production had been cancelled but for which some “industrial muscle memory” remains, but even a US$1 billion cost is only 1.3% of China’s current announced defense budget. China’s defense budget is likely more hardware-centric than the U.S. budget, which is dominated by personnel-related costs.

In terms of the cost of individual aircraft, we think it reasonable to assume the J-20 has a unit cost of somewhere from US$100-to-$120 million. While a variety of factors make the exact cost extremely difficult to assess, for the purposes of very rough comparison this offers a useful benchmark. By contrast, the F-22 costs around US$143 million per plane, and the F-35A US$111.6 million, according to DoD and the National Defense Industry Association. Russia’s T-50 costs “less than US$100 million per plane,” according to RIA Novosti.

The U.S. usually represents the high end of the cost curve by far for high-end defense systems, but we believe that the industrial production cost advantages China enjoys for many simpler systems do not necessarily apply to their highest-end counterparts. For example, the F-16 C/D sells for US$18.8 million per plane (DoD), while the J-10 actually costs more at roughly US$27.8 million per plane, according to Reuters. Production of 20 aircraft per year beginning in the 2014 timeframe at US$110 million per plane would still probably account for only about 2% of China’s defense budget.[1]

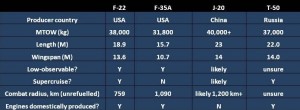

The J-20 versus other 5th-generation fighters

A major question is: can the J-20 be considered a full-fledged 5th-generation aircraft with stealth, high maneuverability, supercruise, sensor fusion, and other such capabilities? Quick “by the numbers” assessment shows that the J-20 is a large aircraft that has the potential to share key characteristics such as low observability and supercruise with its U.S. and Russian peers. Its physical dimensions are particularly interesting, with Dr. Carlo Kopp of Air Power Australia classifying the J-20 as an F-111-class aircraft in terms of its physical size and likely takeoff weight.

The J-20 flight video clips and photos available on the Internet thus far do not show any radical air combat-type maneuvering, but the aircraft’s front canards and movable tail structure suggests that despite the plane’s size, it would be highly nimble—with appropriately powerful engines. The large size also points toward a platform with a large internal fuel capacity and long combat radius, particularly with supercruise capable of carrying significant weapons loads.

Exhibit 3: Comparison of selected late-generation fighter aircraft

|

Source: LockheedMartin, Sukhoi, Aviation Week

Visually, the J-20 resembles an F-22 front end mated with an SU-47/ MiG 1.42 main fuselage, MiG 1.42 wings and canards, and a tail assembly like the Russian T-50, which bears an uncanny resemblance to the Northrop YF-23 (Exhibit 4). The resemblance of aspects of the design to those of U.S. aircraft are noteworthy, particularly given that cyber intruders allegedly traced back to China were able to steal several terabytes worth of data pertaining to the F-35’s design and electronics beginning in 2007, according to the Wall Street Journal.

Exhibit 4: J-20 resembles aspects of other late-gen fighters

Source: USAF, Air Power Australia, FAS, Aviation Explorer, Air Force Technology

Key problems that may restrain further development and moves toward IOC

Materials

To the best of our knowledge, no Chinese sources have published a materials composition breakdown for the J-20. Materials are key in a late-generation fighter for two major reasons. First, the plane must be sufficiently robust to withstand violent maneuvering and the heat generated by sustained high-speed operation. We think China’s aerospace industry now has most if not all of the requisite capabilities. Baoti, one of China’s largest titanium producers, says that it supplies 95% of the titanium used by China’s aerospace complex, suggesting that the company can produce high-grade materials. This is a key point because the other main global suppliers of aerospace grade titanium are all potential competitors—the U.S., Russia, and Japan.

Second, advanced composites and surface coatings (e.g., special radar-absorbing paint) help reduce radar signature. The F-22 and T-50 are each roughly 25% composite by weight. We think it is likely that the early J-20s are more titanium and metal-intensive and that as the design is refined to reduce radar cross section (RCS), the composite content will rise. As China pursues low-observable aircraft and UAVs, we expect significant advances in the domestic composite and coatings industry as the defense complex strives to avoid reliance on key imported components.

The ability to maintain a low-observable platform deserves special attention. Maintaining a low observable aircraft requires substantial human and financial resources. Due to surface wear, an aircraft’s RCS degrades every time the aircraft is flown. The U.S. has almost three decades of experience in maintaining successive generations of stealth aircraft including the F-117, the B-2, and now the F-22 and arguably the B-1B, often under high sortie combat conditions.

A key aspect of this is that each new design incorporates lessons learned from earlier designs even to the point of having experienced crew chiefs assist the design team. Chinese military culture may be less amenable to having such design inputs from personnel who are actually maintaining the aircraft’s “sensitive skin.” Moreover, the J-20 will be China’s low-observable aircraft to operate and maintain.

Engines

Engines are critical for any aircraft. This is one type of system that either works well or does not, with little potential for significant incremental adjustment. Some Russian sources quoted in a recent Sina.com article claim that the J-20 is using AL-41 engines, but most Chinese, Russian, and English-language sources and photo imagery suggest the J-20 prototypes are likely using a version of the WS-10 (already used in the J-11B, according to China Air and Naval Power) and the Russian AL-31 engines (Exhibit 5). According to Shanghai Daily/People’s Daily Online, “two [J-20] prototypes have been developed, with one employing a Russian engine and the other a Chinese one. It wasn’t clear which prototype flew” on 11 January.

Exhibit 5: J-20 prototype engine nozzles are different (top image AL-31, bottom WS-10A)

Source: Jane’s

If that indeed were the case, the aircraft would likely already have the potential to be supercruise-capable. The J-20 exhaust nozzles in Exhibit 6 appear to be jointed in a way that implies thrust vectoring capability, but only further test photos and video footage will be able to confirm this feature.

Exhibit 6: J-20 rear nozzles and Russian T-50’s thrust vectoring powerplant

Source: Russian internet, Sina.com

Chengdu Aircraft Co.’s decision to use both a variant of the WS-10 and the Al-31 suggests that the PLA, the aircraft designers, or both have low confidence in the WS-10’s reliability and thrust vectoring ability. Indeed, China’s 4th-generation fighters still rely heavily on Russian engines, with blog postings on Global Times in late November 2010 reporting that the PLA Air Force (PLAAF) has only recently begun fitting J-10s with the indigenous WS-10A turbofan. On its website, Russian jet engine maker Salut says that it can produce the AL-31F, series 42 M1 engine with thrust vectoring capability.

A Russian aerospace expert recently quoted in Huanqiu Shibao says China’s inability to produce world-class high-performance jet engines will be a major barrier to large-scale production of the J-20 and in the meantime will hinder China’s ability to full test the airframe’s capability in the ways that it could with engines making 35,000-40,000 lbs of thrust like the AL-41 and U.S. F119 engines can.

The Russian experts statements lead to two core logical conclusions: (1) China is unlikely to want to rely on imported components for its latest generation fighter, and (2) in the wake of the disputes over China’s reverse engineering of Flanker variants (into China’s J-11 and J-15) and subsequent slowdown/suspension of new orders of Russian combat aircraft, Saturn and other Russian jet engine makers are unlikely to receive Kremlin approval for selling substantial numbers of high-end engines like the Saturn S117/AL-41 (used in the T-50) to China.

An aviation industry expert tells us that the primary disadvantage of Russian and Chinese engines more than in-flight performance is on-wing and total lifetime, although foreign object damage (FOD) resilience is a significant issue. This could be overcome, in the expert’s view, by simply building a much larger number of engines and a somewhat larger number of airframes to compensate for downtimes—both affordable in theory given Chinese military funding.

Our source likewise states that Russian-built thrust vector engines do not provide the type of air combat maneuvering (ACM) agility that one might expect, but that thrust vectoring does help to reduce fuel consumption (and stress on the airframe) by lessening reliance on primary flight controls. Thrust vectoring entails altering the direction of the exhaust flow in order to control an aircraft’s altitude and angular velocity, typically utilizing a swiveling nozzle.

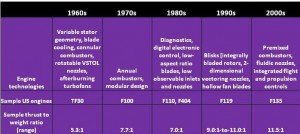

Exhibit 7 shows technical capabilities of select U.S. tactical jet engines, as well as their thrust to weight ratios. The technology and performance parameters by time period displayed in the table suggest that China’s fourth-generation WS-10 is by and large a 1970s or at best a 1980s engine system. The fifth-generation WS-15 now under development, if completed successfully, would bring Chinese engine performance numbers closer to those of the F119.

Exhibit 7: Performance and technology parameters of select U.S. tactical jet engines

Source: GE, Pratt & Whitney, RAND

But China has not yet solved some of the problems associated with the WS-10, and perfecting the WS-15 implies a quantum leap in aeroengine technology. Can China achieve this by 2018 or before? An interim option might be to bring the J-20 to IOC with WS-10/AL-31F engines, but this would entail a very significant stealth penalty. These fourth-generation engines are not stealth-capable, and their largely unshielded intakes and jet nozzles would cause a large infrared signature to be emitted from both engine ends.

Avionics/electronics

We are watching carefully for indications that China has developed sensor fusion capabilities and an advanced active electronically scanned array (AESA) radar systems, which allow an aircraft to scan for adversaries while being hard to detect. AESA systems also confer jamming resistance, an important advantage in an intense electromagnetic environment like that which would likely characterize a modern Asian military contingency.

Personnel/training

Much more so than more automated systems such as missiles, aircraft performance hinges to a great degree on pilot capabilities. In recent years, China has worked hard to develop an elite if still limited corps of increasingly skilled pilots. The skill level of support personnel, particularly for such specialized tasks as maintenance of stealth capabilities, remains uncertain.

Since the 1990s, increasingly realistic training and organizational reforms (including downsizing of personnel, streamlining of bureaucratic structures, and reconfiguration of logistics and maintenance) facilitate modernization of China’s air forces. Facilities, faculty, curricula, and research at PLAAF educational institutions are being improved, in part through increased funding and even monetary rewards.

Officers of unprecedented caliber are being recruited. Increasing the number of civilian-college-graduated officers through the National Defense Student Program is raising technical capabilities and may permit consolidation and merger of other PLAAF and PLA Navy aviation institutions (while raising new service culture challenges). The enlisted corps is being similarly improved. Pilots with a greater level of higher education (military and civilian) are being recruited, and higher performance in challenging situations is already being attributed to their greater theoretical and technical knowledge. The quality and education level of non-commissioned officers (NCOs) remains a problem, however, necessitating remedial education. Cultivating sufficient numbers of experienced combat pilots remains challenging.

The PLA has gradually increased its technological research and development, military and educational exchanges, attaché offices abroad (though few have PLAAF attachés), and has conducted various joint exercises with Russia, Turkey, and other nations. China’s air forces are receiving a larger proportion of PLA personnel and funding as the PLA is transformed into a leaner, more technology-intensive force through successive personnel reductions (particularly of the ground forces).

How would J-20 deployment change PLA air warfare capabilities?

The J-20’s size, range, and stealth could also make it a formidable long-range strike platform, particularly if bomb-carrying planes were mated with air-to-air missile-armed J-20s as part of a strike package to hit high-value targets in the vicinity of the first and second island chains. China is in the process of developing, acquiring, and deploying a number of upgraded air-to-air and air-to-sea/ground missiles that could make the J-20 an even more powerful platform.

A truly low observable, supercruise-capable, well-armed, and well-flown J-20 could, if China can produce sufficient numbers, pose a serious air challenge to the U.S. and its treaty allies in the Pacific region. A high endurance Chinese fighter that is stealthy and can quickly close to shooting distance (with supercruise) would make it much more difficult to protect the tankers and AWACS aircraft that are such as integral part of the U.S. air warfare approach. At the same time, the J-20’s large size and range could make possible deployment at airfields further inland (easier to protect than coastal air bases, but still offering strike range including the main island of Taiwan and other potential flashpoints).

This raises a larger issue for Chinese air forces in general: what type of sortie rate can they sustain in high-end combat conditions? Nobody really knows (including Chinese planners) because China has no modern combat experience in this area. This is a critical metric for the performance of modern air forces. That issue as much if not more than pilot skill is what allowed the Israeli Air Force (IAF) to dominate its opponents in war. Egyptian President Gamal Abdel Nasser remarked after the 1967 Six Day War that the Israeli’s ability to turn sorties (16 times faster than Egypt’s) meant that the IAF was effectively three times larger than its number of aircraft alone would suggest.

More broadly, however, the U.S. is challenged by the fact that it relies on aircraft (particularly carrier based) for high-intensity kinetic operations far more than does China. China’s overall anti-access/area denial (A2/AD) approach is producing a variety of challenges to U.S. power projection in the Western Pacific. Chinese ballistic and cruise missile strikes, for instance, could allow the PLA to shut down enemy air bases and threaten aircraft carrier strike groups (CSGs) and their operations. Surface-to-air missiles (SAMs) can threaten approaching enemy aircraft. The J-20 might fit into this emerging order a multirole aircraft with both air superiority and strike capabilities, thereby combining with anti-ship ballistic missiles (ASBMs) and related systems to serve as a “U.S. advantage killer.”

Perhaps in the common tradition of inter-service rivalry, the J-20 is part of an PLAAF/PLA Navy vs. Second Artillery dynamic, in which the former two services wish to prevent China’s strategic rocket force from monopolizing anti-U.S. carrier strike group capabilities by producing relevant capabilities of their own. Other key elements of the PLA’s larger system include submarines, surface ships, maritime strike aircraft, and even mines.

Even without the J-20, China is still building a formidable air defense system that includes various variants of the Flanker, the J-10, as well as older but upgraded fighters such as the J-8. The problem is that even the most advanced U.S. fighter aircraft, e.g. the F-22, must all be placed at land and sea-based feeder bases within range of an increasing constellation of overlapping Chinese threats.

Implications

Engines will play a key role in determining the capabilities of Chinese military aircraft. This is a key, often overlooked part of combat aircraft programs. The reason Nazi Germany never fielded an effective four-engine bomber in World War II despite several attempts to do so was because it was at least a generation behind the U.S. and the U.K. in the development of engines for large aircraft.

Imperial Japan had similar problems: a generation behind in aircraft engine technology, it tried to design modern combat aircraft around under-performing engines. To save weight, engineers had to sacrifice even the most basic protection measures to include armor and self-sealing fuel tanks. Today’s China is clearly determined to avoid similar bottlenecks, however, and Chinese sources are beginning to claim that significant breakthroughs have been made. This will be a key area to watch.

As the J-20 begins to comprise a larger portion of the PLA’s aerial order of battle, the impetus to export the J-10, including more capable variants than the current export model, is likely to increase. China’s previous military aircraft exports have been largely confined to strategic ally Pakistan and limited number of smaller militaries, particularly in nations that face severe cost limitations and/or in pariah states that lack alternative sources for political reasons. In the coming decade, as with other Chinese-produced platforms and weapons systems, aircraft may enjoy higher demand, with attending geopolitical implications and consequences for regional stability.

To the extent that it proves to be a capable combat system powered by high-performance engines, the J-20’s emergence is likely to shape Russia’s development and sales decisions and India’s acquisition decisions; as well as U.S. fighter development, production, and foreign sales. It may raise difficult questions about the Pentagon’s decision to cap F-22 production at 187 aircraft.

Depending on the feasibility of restarting the Georgia-based production line and reactivating subcontractor linkages at affordable cost, this could increase pressure on the U.S. to field more F-22s and perhaps even to sell the F-22 to key East Asian allies Japan and South Korea. The U.S. is highly unlikely to sell F-22s or even F-35s to Taiwan, however. While based on larger geopolitical concerns, this—together with the A2/AD developments mentioned above—will help to end decisively the era in which Taiwan could counter Mainland Chinese military quantity with its own military quality.

In part because of this larger PLA buildup, and related concerns that regional nations may feel pressured by China, the J-20’s emergence alone (regardless of its development trajectory) will almost certainly prevent the cancellation of the F-35 program. Though designed to be more economical and more focused on air-to-ground missions than the F-22, the F-35 has been developed with the association of many other U.S. allies and friends. Some former F-16 customers may now wish to purchase it.

About Us

China Signpost™ 洞察中国–“Clear, high-impact China analysis.”©

China SignPost™ aims to provide high-quality China analysis and policy recommendations in a concise, accessible form for people whose lives are being affected profoundly by China’s political, economic, and security development. We believe that by presenting practical, apolitical China insights we can help citizens around the world form holistic views that are based on facts, rather than political rhetoric driven by vested interests. We aim to foster better understanding of key internal developments in China, its use of natural resources, its trade policies, and its military and security issues.

China SignPost™ 洞察中国 founders Dr. Andrew Erickson and Mr. Gabe Collins have more than a decade of combined government, academic, and private sector experience in Mandarin Chinese language-based research and analysis of China. Dr. Erickson is an associate professor at the U.S. Naval War College and fellow in the Princeton-Harvard China and the World Program. Mr. Collins is a commodity and security specialist focused on China and Russia.

The authors have published widely on maritime, energy, and security issues relevant to China. An archive of their work is available at www.chinasignpost.com.

The views and opinions contained in China SignPost™ 洞察中国 are those of the authors alone and in no way reflect the views or policies of the authors’ employers. All relevant and eligible contents © Andrew S. Erickson and Gabriel B. Collins, 2010-

[1] The final cost per aircraft would depend on the application of Chinese accounting standards and the extent to which R&D costs are a) properly recorded and allocated to the J-20 project in the first place, b) capitalized at all or simply treated as time cost, and c) allocated to individual aircraft either on “real” or “pro forma” basis. We thank a friend with deep commercial aircraft expertise for sharing this point.