China SignPost™ (洞察中国) #47–A Chinese “Heart” for Large Civilian and Military Aircraft: Strategic and commercial implications of China’s campaign to develop high-bypass turbofan jet engines

Gabriel B. Collins and Andrew S. Erickson, “A Chinese ‘Heart’ for Large Civilian and Military Aircraft: Strategic and Commercial implications of China’s Campaign to Develop High-bypass Turbofan Jet Engines,” China SignPost™ (洞察中国) 47 (19 September 2011).

China SignPost™ 洞察中国–“Clear, high-impact China analysis.”©

Deep Dive—Special In-Depth Report #3

This in-depth report analyzes China’s prospects for building large turbofan jet engines for civilian aircraft, and the potential impact of it succeeding in this area.

Key points

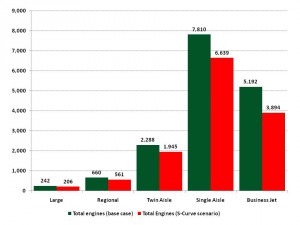

- Buyers in China are expected to purchase 5,000 commercial aircraft and more than 2,300 business jets in the next 20 years, a number of aircraft that could require nearly 16,000 commercial turbofan engines to be purchased in the base scenario and 13,000 engines in the pessimistic growth scenario.

- Major large aircraft buys by China’s military could easily add another 500-1,000 engines to these totals.

- Aviation Industry Corporation of China (AVIC) Commercial Aircraft Engine (ACAE) plans to spend an average of US$300 million per year on jet engine R&D during the next five years, according to People’s Daily.

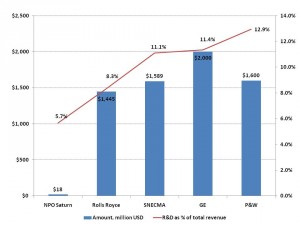

- This is much less than the current jet engine market leaders (Rolls Royce, GE, Pratt & Whitney), who spent between US$1.4 and US$2.0 billion each on R&D in 2010 (8.3% to just under 13% of their respective sales revenue).

- ACAE’s lower investment level may not enable it to catch up and develop a competitive commercial (and military) jet engine construction capability.

- Civilian aeroengine development has military implications. The same large high-bypass turbofans used in civilian airliners can, with little or no modification, power large military aircraft including tankers, transports, Airborne Warning and Control System (AWACS) aircraft, and others. The major U.S. heavy lift aircraft (C-17 and C-5), tankers (KC-10 and KC-135), and AWACS and others (E-3A and P-8A) all either are, or can be, powered by engines that are basically identical to commercial aircraft powerplants.

- Joint ventures with jet engine market leaders like General Electric (GE) have the potential to give the Chinese aerospace industry a 100 piece puzzle with 90 of the pieces already assembled. Enough is left out so that the exporting companies can comply with the letter of the export control laws, but in reality, a rising military power is potentially being given relatively low-cost recipes for building the jet engines needed to power key military power projection platforms including tankers, AWACS, maritime patrol aircraft, transport aircraft, and potentially, subsonic bombers armed with standoff weapons systems.

- While already a significant source of potentially damaging technology transfer, the imperative to prioritize quarterly profits today over long-term profits and strategic concerns may be exacerbated as long-term military spending constraints in Europe, Japan, and now even the U.S. may drive Western aeroengine manufacturers even further into Chinese joint ventures to replace revenue.

- Building these aircraft types would be contingent on advances in China’s ability to indigenously fabricate large airframes. Nonetheless, being able to build the engines indigenously would remove a major barrier.

Large turbofan engines are marvelous in their ability to reliably propel aircraft weighing more than 200 tonnes[1] at speeds of more than 800 km per hour for thousands of kilometers over vast expanses of land and sea hour after hour with very few accidents or even incidents. Yet they can do so only because they are supported constantly by a massive global infrastructure of standards, technology, and technicians.

China aims to enter this field, one of the most challenging endeavors in the world of commercial technology. It is a sector with many barriers to entry, but also a potentially lucrative one with billions of dollars in engine sales and aftermarket service contracts at stake, as well as one that would help ensure China’s ability to produce large military aircraft indigenously, free of dependence on foreign engine suppliers.

Current status of China’s commercial jet engine program

Aviation Industry Corporation of China (AVIC) Commercial Aircraft Engine (ACAE) is investing heavily in the new engine and says that it wants to increase its commercial turbofan design and development staff to 500 people by the end of 2011.[2] This would represent a more than 60% increase in staffing for the company’s commercial turbofan division and the company would like to see 40% of the new hires come from abroad, according to People’s Daily. ACAE is hiring substantially from abroad already and has held a recruitment event in the UK, and is planning one in the U.S.[3]

ACAE plans further expansion, with the company website saying the company plans to add 3,000 staff over the next 5-8 years.[4] To put ACAE’s staffing increase plans into context, an industry expert tells us that to develop a truly indigenous commercial jet engine could require on the order of 5,000 to 10,000 or more workers.[5] For instance, GE and SNECMA may have used a staff of as many as 2,000 engineers and as many as 5,000 or more technicians to develop the CFM56 engine, if all sub-suppliers are counted.[6] Even with this staffing level, electronics, sub-modules, fasteners, and other components came from outside vendors.[7] In light of this, the staffing levels that ACAE currently plans mean that: (1) the engine is unlikely to be fully indigenous and (2) that it is likely to receive substantial “off the books” funding.

In late June 2011, COMAC displayed a 1:2 scale model of the engine, which it calls the CJ-1000A (Exhibit 1). The company also says that it has already conducted trials of prototype engine components and that it intends to release an overall design plan for the CJ-1000A by the end of 2011. The C919 passenger jet is scheduled to enter service in 2016.

It is set to be powered, at least initially, by the CFM International (CFMI) Leap-X1C high-bypass turbofan engine.[8] One of the world’s premier commercial jet engine makers, CFMI is a 50-50 joint venture company between GE Aviation (U.S.) and Snecma (France) formed expressly to produce the CFM56 engine family. Based on the CFM56-5B and CFM56-7B, the Leap-X1C will reportedly offer enhanced composite materials use, a blisk fan in the compressor, a second-generation Twin Annular Pre Swirl (TAPS II) combustor, a ~10-11:1 bypass ratio, and fuel consumption reduced by 16% compared to the CFM56 Tech Insertion engines used in the Airbus A320 and next generation Boeing 737s.[9]

This will give the C919 a world-class state-of-the art engine; the Leap-X will be employed simultaneously on the Airbus A320neo (new engine option) and reportedly also on the Boeing 737 MAX. If this all proceeds as planned, aeroengine hardware per se will be one area in which the C919’s competitors cannot add value to justify higher prices—though there may well be many others, including engine maintenance and global after-service support.

Commercial Aircraft Corporation of China, Ltd./中国商用飞机有限责任公司 (COMAC) hopes to produce up to 2,000 C919s and it appears that while the first aircraft will likely be powered by foreign engines, China aspires to fly later versions of the plane with indigenous power plants, as reflected by an April 2011 Global Times article stating that China’s domestically made large jet engine would enter service “around 2020.”[10]

Exhibit 1: Scale Model of COMAC’s Indigenous Large Jet Engine

Source: COMAC

To us, this suggests that the company feels the commercial jet engine human capital base in China remains inadequate and that it will be more effective to simply try to poach experienced personnel from global commercial engine leaders like Rolls Royce (RR), GE, and Pratt & Whitney (P&W), the “Big Three,” as opposed to developing them in China. Coming years will be interesting in terms of seeing how China’s domestic universities can turn out graduates capable of designing and building competitive commercial turbofans, and in terms of how many “technical haigui” will return to China with critical skills.

ACAE plans to spend an average of US$300 million per year on jet engine R&D during the next five years, according to People’s Daily.[11] For comparison, the current jet engine market leaders (RR, GE, and P&W) spent between US$1.4 and US$2.0 billion each on R&D in 2010 (8.3% to just under 13% of their respective sales revenue). Viewed in this light, ACAE’s investment level may not enable it to catch up and develop a competitive commercial (and military) jet engine construction capability.

An industry expert tells us that possible explanations include: (1) ACAE may in fact have a less advanced goal (either in engine performance or in the degree of integration/indigenization), (2) it enjoys significant off-budget subsidies, (3) its projections are quite over-optimistic, or (4) some combination of these factors. By design or necessity, then, it is always possible that ACAE will focus on assembly and continue to rely on imported components. In any case, since competition in the commercial jet engine sector is an iterated game, and ACAE would likely have the power of the Chinese state behind it, Big Three engine manufacturers would likely only challenge such illegal non-market subsidies (as defined in the World Trade Organization/WTO agreement on Subsidies and Countervailing Measures) if Chinese aeroengines became competitive on the global marketplace.

Exhibit 2: Global jet engine maker R&D investment comparison

Amount in million USD (left vertical axis), % of sales (right vertical axis), 2010

Source: Company reports, China Securities Journal, CIA World Factbook

Requirements for successful commercial aeroengine development

China will need to develop a general product development strategy. Options include stand-alone engines for each aircraft type, or a family concept like P&W’s Geared Turbofan (GTF) or RR’s Trent; as well as focusing on certain aircraft types/sizes or serving as an across-the-board supplier.

A general architecture strategy necessiates important choices. Among Big Three aeroengine manufactueres, one of the most important choices has involved three shafts vs. two shafts. RR’s Trent employs a relatively complex three-shaft-design, which it advertises as offering sufficiently enhanced engine rigidity and reduced performance degradation in service to justify a price premium. P&W’s GTF, its new-generation engine for the Airbus 320Neo and the Mitsubishi Regional Jet (MRJ), is advertised to have impressive fuel efficiency.

From a functional perspective, challenges fall into several categories. First, there is the engineering itself. This involves exhaust gas temperature (EGT) margin stability; acceleration/deceleration properties; cold/hot start properties; high and hot (H&H) performance; general performance; foreign object damage (FOD) resistance; volcanic ash resistance; high angle of attack (AOA) performance to avoid airflow disruption; vibration resistance of the entire engine, including the engine control unit (ECU); fuel lines; and emissions/noise trade-offs (carbon dioxide vs. nitrogen oxide vs. dirt vs. noise). Emissions/noise trade-offs are particularly complex, as the relevant regulations can vary by time and market. It is fairly easy to reduce CO2 emissions, but only at the expense of increasing noise and particulate emissions; how to optimize these parameters against eachother and maintain the balance over time is challenging.

Even basic areas that might appear ripe for outsourcing to subcontractors can produce serious systemic problems. Typical “low-tech weak points” include the gear box, starter, and variable stator vane (VSV) system. The tradeoffs assumed in developing and integrating these systems typically impose significant design implications and path dependency.

The technological and systemic challenge of integrating an aeroengine with an aircraft as a whole is significant. Effective coordination of objectives and activities by COMAC and ACAE will be essential; otherwise, significant problems and suboptimal outcomes could manifest themselves. Even in a best-case scenario, decisions regarding such as hydraulic and electrical systems can lead to major unintended consequences. Optimization of integration and maintainability among such key components as the engine, nacelles, cowlings, pylon, and thrust-reversers, is another important factor. Engine efficiency despends to a large degree on efficient air inflow; the aerodynamic configuration of the inlet cowling alone can make a meaningful difference in efficiency (e.g., as measured in fuel burn).

Other principal requirements include:

–Performance guarantees (regarding thrust; on-wing-life; reliability/plannability—mean time between failures/MTBF, i.e., how long an engine lasts; and mean time before overhaul/MTBO, i.e., how often an engine must be serviced fully) impose non-fungible requirements.

–Design/total lifecycle management tools (including computational fluid dynamics capabilities).

–U.S. Federal Aviation Administration (FAA)-European Aviation Safety Agency (EASA) certification. This requires transparency regarding design processes and intellectual property (IP), making IP theft difficult to conceal.

–Extended Twin Operations (ETOPS) certification. This FAA/EASA-Japan Aviation Administration (JAA) global rule allows twin-engined airliners to fly long-distance routes, thereby increasing reliability demands on aeroengines.

–Maintainability, including ease of engine change, ease of replacing submodules (e.g., swapping access panels without dissassembly), ease of correcting for vibrations, transportability of engines (i.e., some GE90 variants must be split to fit into B747 freighter) is a major consideration of potential purchaser airlines.

–Global spare parts and special tooling (e.g., installation slings, engine change kits) support (in-house vs. outsourced after-service function).

–Parts manufacturing authority (PMA) parts policies/management/lock-out.

–Global spare engine availability. A global engine population is far more costly to maintain than the ~200 engines that might be needed to support China’s domestic market.

–Global 24/7 “Aircraft on Ground” (AOG) support.

–Global 24/7 engineering support.

–Credible Airworthiness Directive (AD)/ Service Bulletin (SB) management to address mandatory inspections and modifications.

–Functional and customer-friendly training—service culture matters in a competitive market.

–Residual value guarantees for first (many) launch customer(s) that front-loads cost and liability for aeroengine producers.

–Financing is an important factor in attracting customers.

–Pricing (in US$ or RMB)? Implications of US$ pricing given likely long term changes in USD-RMB exchange rates.

These factors will be explored in the context of China’s specific conditions in subsequent sections.

What is at stake as China tries to build a commercial jet engine?

Prospective Chinese jet engine makers are driven by a range of strategic and economic motivations. On the commercial side, the vast engine sales and service market in China will create a wealth of opportunities for Chinese engine makers to exploit. Citibank has estimated that some jet engine makers may derive seven times the revenue from aftermarket service and parts sales for their engines that they do from the sale of the powerplants themselves.[12]

For example, in 2010, GE Aviation obtained 36% of its $17.6 billion in total revenues from servicing commercial engines, 25% from selling commercial engines, and 23% from selling and servicing military engines. Also, servicing jet engines tends to be much more profitable than selling the engines themselves, leading some analysts to say that many engines makers “sell the hot air moving out of engines” as opposed to the engines themselves (Economist).

Buyers in China are expected to purchase 5,000 commercial aircraft and more than 2,300 business jets in the next 20 years, a number of aircraft that could require nearly 16,000 commercial turbofan engines to be purchased in the base scenario and 13,000 engines in the pessimistic growth scenario (Exhibit 3).[13] Either way, the likely engine needs of China’s commercial aviation sector are going to be huge in the coming two decades. Atop this, major large aircraft buys by China’s military could easily add another 500-1,000 engines to these totals.

Exhibit 3: Potential Chinese Demand for Large Jet Engines for airliners and business jets[14]

Source: Boeing, Bombardier, CFMI, China SignPost™

Engine demand comes from a base assumption of 2 engines in each aircraft, plus an inventory of one spare engine for each 10 engines in operation. Of the engines needed, at least half are likely to need to produce 20,000 or more pounds of thrust, enabling them to power civilian airliners as well as a range of military transport and tanker aircraft.

In addition, if Chinese firms can master commercial jet engine production, they may be able to also eventually enter the export market by packaging Chinese engines with Chinese-made passenger aircraft. AVIC could order that Chinese-made aeroengines be included on aircraft sold by the company. A key question is how the resulting aircraft would sell in a competitive market. Foreign buyers could simply decline to purchase them, but Chinese airlines would confront a more complex situation. Faced with official indigenous engine use requirements, Chinese airlines could not refuse outright, but could nevertheless marginalize/minimalize/sideline said aircraft in practice.

Chinese commercial jet engine exports are at a minimum many years away, but given China’s record of becoming a serious export competitor once it masters domestic production of a product, is one that deserves consideration. Emerging markets in which China is building an increasing economic presence are among the largest growth markets for commercial aircraft over the next 20 years.

On the strategic side, government and company officials may also seek to reduce China’s dependence on P&W, GE, and RR for its jet engines. This would be driven primarily by a desire to be able to power future Chinese military tanker, transport, and airborne early warning (AEW) aircraft with domestically-made engines that would never be hostage to embargoes or disputes over prices and other issues with foreign suppliers (this strategy only works if all critical subcomponents and parts are produced indigenously).

A country can build a robust commercial aircraft industry with a global supply chain, as Embraer has done in Brazil, but reducing reliance on foreign vendors offers strategic advantages for military aircraft production. Eliminating reliance, by contrast, is typically unrealistic: at present even the U.S. uses foreign engine technology for some of its military aircraft; for example, many U.S. non-combat military aircraft are powered by CFM engines, from a U.S.-French joint venture, and even the content of combat aircraft engines is not 100% U.S. domestically designed/produced. For China to even approach this level of limited reliance would be a very tall order indeed.

Prestige and Development of Other Industries

China’s desire to build commercial jet engines is also likely driven by national industrial pride and the desire to develop other industries. For example, aero-derivative gas turbines can be used as “stand-alone” powerplants to generate electricity. Jet engine derivatives can be used to power ships, especially those for which speed is an issue; a “low performing” jet engine can still make a potent propulsion system for frigates, destroyers, and cruisers.

Jet engine production involves exceedingly complex supply chains and ACAE will face significant challenges in creating a sufficiently large and flexible supplier base when it becomes capable of producing its own commercial engines. The company’s status as an aspiring producer of commercial and military engines both means that it is likely to try and obtain as many components as possible domestically. NPO Saturn currently sources more than 90% of its components locally and we believe that ACAE is more likely to take this route than it is to emulate a global supply chain approach such as that used by RR, for example.

ACAE might achieve such a local sourcing goal as a second or third step; going indigenous for all subassemblies and parts would take a very long time and make for “non-disaggregated” learning curve(s). It would be much easier to design one or a few components domestically and see how they hold up in otherwise “reliable” imported systems and next higher assemblies (NHAs)[15] rather than having the NHA fail in its entirety and not knowing where to start the root cause analysis. In terms of industrial clustering of manufacturers and suppliers, the Xi’an, Chengdu, Shenyang, and Shanghai areas will be the primary zones of importance.

Joint Ventures and Subcontractors

To reduce NHA failure risk, ACAE may emulate the Big Three engine makers’ production model. This involves identifying the 5-10 most critical sub-modules, thereby narrowing down areas of potential problems. It entails roughly 80% indigenous and 20% foreign content. China’s reported allocation of people and resources to date appears inconsistent with an all-indigenous aeroengine approach. Indeed, even the Big Three themselves do not pursue such an approach—to do so would be too expensive and too risky technologically.

That is where joint ventures (JVs) play a useful role. Aviation is a low-quantity business, making economies of scale and learning curves tremendously important. As a leading aeroengine producer, GE makes only several thousand engines per year. By comparison, auto plants of major manufacturers such as Honda often have the capacity to produce 250,000 or more vehicles per year and in the U.S. typically run at capacity utilization rates of between 60% and 90%, depending on economic conditions.[16]

It is thus no accident that CFM engines are produced by a JV involving GE and SNECMA: this distributes risk, matches complementary expertise, and enhances financing and market access. GE, for instance, lacks technological knowledge in certain specialized areas, especially in low-level assemblies, e.g., with specialized clamps. It would be tremendously inefficient for GE to develop such expertise.

Chinese engine makers are likely to make even greater use of JVs, but likely have different motives, incentives, and constraints because of their government connections and subsidies. Their pursuit of dual-use civilian and military technology and expertise is likely to be much better coordinated and targeted to further military programs that cannot obtain such advances directly. With respect to indigenization and production, their approach will likely be to identify which subcomponents, assemblies, and parts are lacking in China, and have JVs focus on the most important ones. Prioritized items will likely include those that (1) cannot be purchased freely on the world market, because of export controls or monopolistic supplier structures; and (2) offer critical knowledge for military programs.

Examples include high-pressure turbine technology and airflow computational software. A counterexample would be clamps and big fan cases for which there are several global suppliers, and for which supply is not restricted. In practice, where parts are localized will likely hinge on both production logic and path dependence in China’s industrial base. If a certain facility has historically produced a certain type of component or system, and retains the requisite bureaucratic support, it is likely to retain ownership of those areas to protect “rice bowls.”

IP and tech transfer challenges

In public statements, foreign companies express confidence that Chinese firms will not be able to obtain and reverse engineer, or improve on their engine technology. For example, in June 2011 Chaker Charour of CFMI told the Wall Street Journal that the company does not see an indigenous Chinese jet engine as a near-term threat. “We’re not really concerned with intellectual property in China,” he adds. “We know how to integrate with them without transferring technology. We know how to play that game and protect our property.” Such statements are in fact made to maintain good relations with Chinese decision-makers and to avoid looking weak vis-à-vis competitors; in fact, we are told that all foreign companies are extremely worried, as none has found an effective way of protecting IP.

CFMI tells us it has signed a memorandum of understanding (MOU) with AVIC “to discuss the potential of establishing a final assembly line in Shanghai, as well as an engine test facility, but nothing has been finalized. The working team noted the in that release is still developing a viable business model. There are many factors to be considered and, at this point, we have not yet determined where LEAP final assembly will take place. We do source extensively in China for our current product line, so I am certain that will remain the case for LEAP, however, we are also still in the process of selecting our suppliers overall, so it is too early to say what parts will be produced in China.”[17]

We suspect one of the reasons the process is taking so long is because the engine makers want to use the “maquiladora model” in China whereby they fabricate the most critical components (such as turbine blades) in places where they know their intellectual property will be protected, and then ship them to China for final assembly. Airbus’s state-of-the-art Tianjin assembly line, the most modern foreign airliner assembly facility in China today, is a case in point. Airbus fabricates the parts at its Hamburg, Germany plant, and then ships all of the components to Tianjin for final assembly.[18] In this case, China-based assembly does not even seem to be driven by cost concerns. Rather, it is driven by the importance of having a figurehead manufacturing element on Chinese soil in order to secure product sales in that market, as well as the creation of production capacity needed above and beyond the Toulouse (TLS) and Hamburg (HAM) final assembly lines (FALs).

China’s auto industry has had similar experiences with JVs with foreign partners that in reality either transferred little technology overall or only transferred technologies that were basically obsolete in developed markets. This issue is likely to remain a sticking point between ACAE and potential foreign engine manufacturing partners because China will work hard to avoid being a secondary market into which outmoded technologies can be transferred to wring out a bit more profit. Automotive components, for instance, offer a great example of how IP protection did not work. Today, following years of assiduous technology transfer effort by multiple means, many Chinese JV partners are serious competitors in the domestic automotive component industry, threatening foreign suppliers, including in the area of R&D.

What are the differences between military jet engines and commercial engines?

There is a reason why there are only a handful of globally trusted aeroengine producers in the world at this time—it is a very difficult business indeed, and there is no tolerance for error. China is making progress in both fields, but there are substantial differences. Military engines represent primarily an engineering challenge, a key Chinese strength.

Civilian engines, by contrast, require engineering (R&D); design-to-cost; global support (e.g., parts, cosignment inventory, engineering, aircraft on ground/AOG status, training, spare engines, airworthiness directive/AD and service bulletin/SB management, parts manufacturing authority /PMA parts policies/management/lock-out); residual value guarantees; FAA/EASA certifiability; global management; cooperation; as well as IP coordination and guarantees that whatever IP is used in the first place was obtained licitly.

After-market service comes with very strong expectations per global industry standards. AOG status means that an aircraft has been grounded, entitling it to priority service from suppliers, albeit at a price premium. Servicing within 24 hours is typically expected, with only 12 hours allowable in some cases. This norm must be upheld or clients will hesitate to procure products; establishing a large warehouse in the Seattle, WA area dramatically enhanced Airbus’s spare parts supply in the U.S., and hence greatly facilitated its market entry there.

Safety must be ensured on a 24-7-365 basis or international standards bodies will rescind certifications. For instance, ADs are internationally standardized means by which commercial regulatory authorities can communicate urgent action requests to aviation operators, i.e., concerning a specific aircraft type or component, regarding mandatory actions to be taken (e.g., grounding, inspection, and replacement). SBs are global standards communications means between an original equipment manufacturer (OEM, e.g. a Chinese aeroengine manufacturer) and an operator (e.g., a foreign airline).

Meeting such requirements demands both performance and service delivery, with little room for learning on-the-job. This requires a responsive managerial setup and a global resource and service network, including technically-qualified English speakers to ensure real-time global product service and thereby ensure consumer safety and confidence. A fully indigenous engine might require 500-1,000 people for ongoing customer support alone. The range of technology on sub-modules requires a range of experts on all areas to issue SBs at any time. For this, good coordination with subcontractors in real time is imperative. Here, unauthorized technical shortcuts to speed development and production could prove extremely costly in the long run. Airline requirements can include borrowing special tools per prior customer service agreement. Service is the key to profits, and keeping initial engine prices low to attract customers.

In contrast to OEM parts, PMA parts are generic. Like a printer and its ink cartridges, an aeroengine itself is relatively cheap compared to the costs of parts and servicing over time. PMA parts offer airlines a key way to control costs, since OEM parts typically carry a hefty markup. PMA versions are typically only available for lower-performance, less-sensitive parts, e.g., screws, washers, clamps, and less-demanding fan blades. At a mere 20-30% of OEM part costs, they offer the same properties, and sometimes better performance. Compatibility can be an issue, and what PMA usage aeroengine manufacturers will accept grudgingly from what customers (e.g., tolerating PMA parts for lower-performance spares) is the subject of constant negotiation. Some companies do not allow PMA parts on leased aircraft. Litigation and counter-litigation concerning technical prominence and performance of parts, especially PMA parts, occurs constantly.

Residual value guarantees represent commitments by manufacturers to make up the difference between expected and actual market value after a fixed period of time (e.g., for resale after 5 years). They can be critical to securing a sale, are required by aeroengine buyers in many cases, and would likely be demanded for all Chinese aeroengines, at least initially. This is on top of a warranty, typically lasting 2-5 years, negotiated individually, and documented in a detailed multi-paged contract stipulating specific provisions. To ensure confidence in its products, a Chinese aeroengine manufacturer would have to go far beyond providing the generous warranties that eased Korean manufacturer Hyundai’s automobiles into the U.S. market despite concerns about their reliability.[19]

One area in which Chinese aeroengine suppliers may actually already enjoy an advantage is in financing. Chinese government organizations and SOEs can draw on substantial resources when authorized, and have significant experience in tailoring financing to a client’s needs. A complicating factor is pricing currency, as thus far the U.S. dollar remains the global transaction standard. To the extent that China attempts to indigenize aeroengine inputs, it will lack a natural hedge against the exchange rate. With the RMB likely to appreciate further, this creates an unfavorable dynamic for an exporter. This is likely surmountable given policy prioritization of aeroengine development, but will impose additional costs.

Designing engines based on tight operating and ownership cost parameters and providing reliable global technical and maintenance support represent key weaknesses and gaps in capability that may hinder China’s ability to enter and compete successfully in the global market. For military applications, performance is more important than cost. For civilian applications, the total cost of ownership (TCO)—over the entire life cycle of the engine—is far more important than marginal increases in performance, once a sufficient level is reached.

The initial purchase price of a civil aeroengine pales in importance compared to the on-wing time and maintenance costs over the total operational lifecycle. The aviation industry, in which a major airline consumes several billion dollars of fuel per year, is extremely sensitive to total operating costs. Here Chinese products would face a very different calculus than in other markets; Chinese aeroengines, if they were to be sold at low prices but could not demonstrate high reliability and low total operating and ownership costs, could be viewed widely as a source of false economy.

It is unclear exactly how much ACAE’s leadership truly understands how difficult complying with global certifications and efficiency benchmarks can be in practice. Their bureaucratic-corporate positions may make them far more attuned to technical manufacturing standards than to international after-market service demands. This is a problem of both culture and resource allocation.

Chinese firms have yet to prove themselves in the critical areas of design, certification, sales, servicing, and other after-market support; these remain terra incognita for them in virtually all respects for commercial aviation inasmuch as Chinese aircraft/engine OEMs have not yet placed products with leading operators outside China. In addition, widely available service infrastructure makes engines for large commercial jets more attractive for military applications. With respect to the CFM56 (military designation F108) engine that powers the KC-135 Stratotanker, Snecma notes that “The use of a Commercial Off the Shelf (COTS) product has allowed the USAF to leverage commercial experience and hardware improvements into its fleet. The worldwide base of commercial repair facilities also provides the USAF with a significant level of “warm base” support.”[20]

Another vital difference is that for China’s military jet engine programs to have a major positive impact on the country’s ability to produce fighters that can attain 5th-generation aerodynamic performance with indigenous components, it only needs to reach 1990s-level technology standards (meaning engines analogous to the P&W F119 that powers the F-22 Raptor). With the bar slightly lower, even just attaining the ability to reliably mass produce engines with performance equivalent to the 1980s-era P&W F100 or GE F110, which power the F-15 and F-16, would enable China to build its J-10, J-11, and J-15 fighters entirely from domestically-made parts, a major strategic improvement.

For “hare-like” military engines, peak performance is the key variable. This necessitates such specific efforts as squeezing the last bit of performance out of a given alloy. Other factors may be compensated for as the user sees fit; for example, engine maintenance and life limitations may be addressed to some extent by purchasing additional engines. This calls to mind country western singer Toby Keith’s lyric “I’m not all that I once was, but for once I’m all that I ever was.” This makes for a good song and a tolerable military turbofan in a developing country—but not a civilian engine in a competitive developed market.

“Tortoise-like” civilian turbofans, in contrast, support commercial activity and are judged on long-term profitability. This makes them arguably more technologically challenging overall. Commercial engines need to be at or very near the global state of the art in terms of fuel efficiency; durability (on-wing life); reliability; exhaust gas temperature (EGT) margin stability; emissions; noise; weight; maintainability; optimization of fit between the engine, cowls, nacelles, thrust reversers (TRs),[21] etc.; and safety to be competitive in the market. EGT monitoring and management is essential to maximizing fuel burning efficiency and avoiding metal fatigue. It is easy to design for increased thrust; keeping it stable over time on-wing even with gradually deteriorating subcomponents is the real challenge.

Beijing could conceivably create a protected market space for less advanced Chinese-built commercial jet engines by using indigenous content rules that mandate the use of domestically-made engines in aircraft sold to operators based in China. That said, it is unlikely that Chinese airline executives will be content with lower profits caused by having to fly their aircraft with inferior, less efficient domestic engines. They would also face customer defection on routes served by foreign airlines with more efficient, safer engines. Furthermore, Chinese carriers—and any non-Chinese user, for that matter—might fear that in case of serious quality/reliability/safety issues putting pressure on Chinese engine OEMs could be much more difficult than on foreign engine OEMs due to the nature of ownership of the former and the prevalence of the user base of the latter.

Given such perceptions, China’s own airline CEOs could remain a very powerful base of support for using foreign-made engines if Chinese-made commercial engines cannot rapidly attain the performance and efficiency parameters of the CFM56 or newer Leap-X engines. As a harbinger of Chinese airlines putting their interests in customer preferences and quarterly profits before those of long-term national development goals, we note that state-controlled airlines in China have already pushed back against the government because they do not want to make substantial promises to purchase the domestically-made ARJ21 and C919 airliners, despite Beijing’s desire to see COMAC grow into one of the world’s key producers of regional jets and larger airliners.[22] Moreover, other “non-commercial/-profit” factors such as the aforementioned, especially the ability—or lack thereof—to put pressure on a state owned enterprise (SOE) like AVIC in case of problems, may exert influence.

Development and Maintenance Challenges

Military turbofans’ development must typically be far more independent of foreign assistance than that of their civilian counterparts, particularly for a nation that is relatively new to the field (or at least its advanced commercial areas), such as China. By contrast, in civil engines, the low-pressure components and turbofans can benefit from extensive joint ventures and foreign suppliers of sub-modules. Industrial espionage is also much easier in the civilian realm, as information controls are far more relaxed. For high-pressure components, by contrast, it is much harder to get help even in the civilian realm, and in the military realm it is often virtually impossible.

Sales and Services

Chinese military turbofan engines are built with the assumption that the primary customer is the People’s Liberation Army (PLA), with the additional possibility of small-scale exports to friendly countries that lack ability to set standards or otherwise influence the product. Hence, the primary challenge is engineering.

Civilian turbofans, by contrast, face a complex, demanding, and constantly yet unpredictably evolving set of end user expectations over thousands of flights. Engineering is not the primary challenge; rather, supply, after-market servicing, and intellectual property rights (IPR) management are the greatest trials (as well as the other issues mentioned above). Both domestic and foreign customers have unyielding efficiency and safety expectations and—in case of certification by the FAA/EASA—complete transparency requirements in case of mistakes, and even along a normal “steady-as-she-goes” design/manufacturing process.

No special exceptions can be made even for a government-supported national champion aircraft such as the COMAC C919. This would potentially go against critical aspects of the corporate culture found in many Chinese SOEs. Engines constantly face maintenance issues and risk FOD at any time. Maintaining and supporting engines overseas requires sophisticated engineering and spare support infrastructure. Engineering and design chain management, and especially supply chain management, are extremely difficult. Technology partnerships and sub-modules delivery (i.e., obtaining engine control units from Honeywell) offer useful opportunities, but raise complex contractual and IPR issues.

Certification

Civilian engines must pass demanding certification processes in each of the major advanced markets in which they will be used. To be a top-tier supplier, one’s engines must be certified by the FAA and EASA, as well as JAA, which has an independent process that draws on the former two metrics. These are extremely difficult markets to enter and stay in. Providers of aviation liability/risk insurance compel airlines to compel regulators to demand these extremely complex, but entrenched and effective standards that are critical to ensuring safety in an unforgiving operating environment.

Lower-tier producers that cannot meet these demanding standards are restricted to limited, less-desirable markets. Aircraft that use Russian aeroengines, e.g., Tupolev aircraft flown by the Russian carrier Aeroflot, cannot be sold to top-tier international carriers that operate in the lucrative North American, European, or Japanese markets.

Meeting FAA/EASA standards is extremely demanding, in terms of both quality and process. Being systematic, remaining transparent, and maintaining route traceability are mandatory. The relevant FAA inspector’s design process handbook runs to several thousand pages.[23] It stipulates how to keep track of changes in engineering drawings, changes must be authorized, how quality control gates must be managed, and how documentation must be filed and processed. Requirements include an English-language document specifying how to number different versions of a drawing.

If FAA/EASA standards are revised, this necessitates painstaking revisions to such a numbering document, as well as thousands of pages of other paperwork. Every single screw, shim, bolt, fastener, and rivet must be certificated. The paperwork needed to document the design and certification of a single new screw, bolt, washer, or clip nut runs to several inches in thickness.

These standards cover all aspects of aircraft design and production, not just aeroengines. The slightest failure to achieve formal or substantive compliance has immediate consequences, even for non-working parts of an aircraft, let alone its vital propulsion systems. Depending on the nature of the shortfall, a single aircraft or even all the aircraft of a given type may be grounded. This is precisely what happened with Boeing 737-800 and Airbus aircraft that used seats produced by Koito.

When it was discovered that the Japanese company had falsified fire resistance and strength test results (on as many as 150,000 seats on 1,000 aircraft from 32 airlines), the aircraft using the seats were delayed in delivery, and as a result Boeing and Airbus immediately selected alternate suppliers and replaced the seats.[24] In addition to these major OEMs, some airlines are currently working with Koito to get their old seats certificated. Magnitude and expense are no excuse for delay when it comes to meeting standards.

Becoming “certificated” by the FAA and its counterparts thus has huge implications for design processes, and how people are qualified. How China will address these requirements in its aeroengine/aircraft development remains an open question. The ARJ-21 did not comply with the process during its development. China is now trying to “back end” its way into FAA compliance, but will likely not succeed—and that is affordable for China, as the ARJ-21 is intended primarily as a low-volume, likely non-profitable “test project” or “stepping stone,” rather than a major commercial success in its own right. But China has much higher expectations for the COMAC C-919—it must become an alternative to Boeing and Airbus in its own right.

Unlike with certain WTO provisions and other international norms, safety and commercial interests in the aviation industry make it too hard for Beijing to easily “steamroll” standards. This places a premium on what will happen with the C919, on which China is lavishing billions to make it succeed. Accordingly, China, working in consultation with foreign JV partners, is involving the FAA at a much earlier development stage. Yet it probably still faces a rude awakening in meeting demanding standards that it cannot simply bend to its perceived local necessities.

The exacting and meticulous FAA/EASA standards requirements, in accordance with the highest safety regulations and federal laws, also raise intriguing questions regarding how China could deal with irregular development processes and any unauthorized covert incorporation of foreign technology (e.g., of A320 technology in the C919). Conceivably, this might require reverse engineering both the design and the testing process in real time to hide any illicit technology transfer. While such procedures are certainly possible, they would add considerable cost, complexity, and potential for error.

Civilian Military Integration (CMI) Potential

In most countries that attempt military and civil aeroengine production, the same organizations and firms are involved in both sectors, and military programs in effect subsidize civilian programs. This is vital, as a new generation civilian engine such as the CFM56 can require something on the order of $5 billion to develop, test, and certify. The one major technology power to attempt civilian-centric aeroengine production, Japan, has not succeeded, and lack of military subsidies is one of the key explanations.

Civilian aeroengine development can also help military aeroengine development. It is much easier for civilian entities to obtain such capabilities as foreign design/lifecycle management software, project management tools/systems for multiple parallel critical paths, test cell design, managerial processes, design processes, and revision and document control. These can then be transferred in some form to military counterparts.

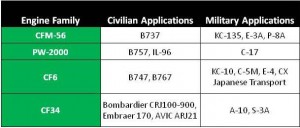

Perhaps most notably, the same large high-bypass turbofans used in civilian airliners can, with little or no modification, power large military aircraft including tankers, transports, and AWACS. The major U.S. heavy lift aircraft (C-17 and C-5), tankers (KC-10 and KC-135), and AWACS and others (E-3A and P-8A) all either are, or can be, powered by engines that are basically identical to commercial aircraft powerplants.

For example, CFM56 series engines like those that power the Boeing 737 and Airbus A320 single-aisle airliners are also used in the KC-135 tanker, E-3A AWACS, and P-8A maritime patrol aircraft (which is itself essentially a modified B737-800 smaller airframe with a slightly modified 737-900-derived larger wing, the better to hold additional fuel and allow thicker aluminum skin to better withstand the marine environment). Lockheed’s C5-M Super Galaxy military transport uses CF6 engines. Similarly, the PW2000 turbofan that powers the Boeing 757 and Ilyushin IL-96 airliners is the base for the F117 PW100 engine used in the C-17 transport aircraft, the backbone of the U.S. airlifter fleet (Exhibit 4).

Exhibit 4: Civilian-Military Crossover for Select Large Aircraft Engines

Source: GE, P&W, Boeing

Strategic implications of large engine production

Joint ventures with jet engine market leaders like GE have the potential to give the Chinese aerospace industry a 100 piece puzzle with 90 of the pieces already assembled. Enough is left out so that the exporting companies can comply with the letter of the export control laws, but in reality, a rising military power is potentially being given relatively low-cost recipes for building large jet engines that could power key military power projection platforms which could be regionally destabilizing.

While already a significant source of potentially damaging technology transfer, the imperative to prioritize quarterly profits today over long-term profits and strategic concerns may be exacerbated as long-term military spending constraints in Europe, Japan, and now even the U.S. may drive Western aeroengine manufacturers even further into Chinese JVs to replace revenue.

Building these aircraft types, including tankers, AWACS, maritime patrol aircraft, transport aircraft, and potentially, subsonic bombers armed with standoff weapons systems, would be contingent on advances in China’s ability to indigenously fabricate large airframes. Nonetheless, being able to build the engines indigenously would remove a major barrier.

Commonality is an interesting topic, with countervailing implications. The more commonality Chinese-made engines have, the more selling them to non-Chinese users could become an issue. What if the PLA vetoes selling essentially the same engine that powers its AWACs, tankers, etc. to, say, a potential adversary like the U.S.? And even if that PLA requirement is not made explicit, what would need to be done to convince a non-Chinese airline customer that might buy a Chinese-made engine on the basis of a 15-year-long business plan that this sort of threat would never materialize? What if tensions between the U.S. and China worsen to the extent that spare and engineering support gets cut off? What about the very long-term prospects of fitting a Chinese-made engine on a non-Chinese airframe? China’s growing prowess in civilian aeroengine production raises some very complex long-term questions for all concerned.

About Us

China Signpost™ 洞察中国–“Clear, high-impact China analysis.”©

China SignPost™ aims to provide high-quality China analysis and policy recommendations in a concise, accessible form for people whose lives are being affected profoundly by China’s political, economic, and security development. We believe that by presenting practical, apolitical China insights we can help citizens around the world form holistic views that are based on facts, rather than political rhetoric driven by vested interests. We aim to foster better understanding of key internal developments in China, its use of natural resources, its trade policies, and its military and security issues.

China SignPost™ 洞察中国 founders Dr. Andrew Erickson and Mr. Gabe Collins have more than a decade of combined government, academic, and private sector experience in Mandarin Chinese language-based research and analysis of China. Dr. Erickson is an Associate Professor at the U.S. Naval War College’s China Maritime Studies Institute (CMSI) and an Associate in Research at Harvard’s John King Fairbank Center for Chinese Studies. Mr. Collins is a J.D. candidate at the University of Michigan Law School and focuses on commodity and security issues in China, Russia, and Latin America.

The positions expressed here are the authors’ personal views. They do not represent the U.S. Naval War College, Navy, Department of Defense, or Government, and do not necessarily reflect the policies or estimates of these or any other organizations.

The authors have published widely on maritime, energy, and security issues relevant to China. An archive of their work is available at www.chinasignpost.com.

[1] Boeing 737s and Airbus 320 family-type aircraft are lighter, and regional and business jets lighter still.

[2] “British talent may join China’s large aircraft project,” People’s Daily, 24 March 2011, http://english.peopledaily.com.cn/90001/90778/90860/7330324.html.

[3] Ibid.

[4] “Staffing Management and Ideas,” AVIC Commercial Aircraft Engine (ACAE), http://www.acae.com.cn/ACAENEWWEB/ACAE/ACAE_RCZX/ACAE_RCZX_ZLRLZYKFYGL/default.asp.

[5] Interview, September 2011.

[6] Ibid.

[7] Ibid.

http://online.wsj.com/article/SB10001424052702303310004576393501621845100.html, http://www.cfm56.com/press/news/cfm+international+and+comac+sign+master+contract+to+finalize+leap-powered+c919+agreement/608.

[9] “CFM Unveils New LEAP-X Engine,” CFMI, 13 July 2008, http://www.cfm56.com/press/news/cfm+unveils+new+leap-x+engine/441.

[10] “New Breakthrough: Domestically-made Large Aircraft Engine Should Enter Service Around 2020,” Global Times, 3 April 2011, http://mil.huanqiu.com/china/2011-04/1608129.html.

[11] AVIC to invest 10 billion yuan in engine R&D,” 13 April 2011, People’s Daily, http://english.peopledaily.com.cn/90001/98649/7349148.html.

[12] “Rolls Royce: Britain’s Lonely High Flier,” The Economist, 8 January 2009, http://www.economist.com/node/12887368.

[13] Data from Boeing and Bombardier China market forecasts.

[14] The S-Curve scenario is based on our prior analytical work on potential risks that could move China’s economic growth onto a slower path and assumes a 15% lower demand for commercial airliners and a 25% lower demand for business jets, which are likely to be even more price sensitive. See Gabe Collins and Andrew Erickson, “China’s S-Curve Trajectory: Structural factors will likely slow the growth of China’s economy and comprehensive national power,” China SignPost™ (洞察中国), No. 44 (15 August 2011), http://www.chinasignpost.com/2011/08/china%e2%80%99s-s-curve-trajectory-structural-factors-will-likely-slow-the-growth-of-china%e2%80%99s-economy-and-comprehensive-national-power/.

[15] A NHA is the product of given subcomponents.

[16] East Liberty Auto Plant, Honda of America Manufacturing, http://www.ohio.honda.com/manufacturing/elap.cfm. See also Bill Visnic, “Despite Slim-down, Automakers Still Hung With Too Much Capacity,” Edmunds Auto Observer, 27 August 2010, http://www.autoobserver.com/2010/08/despite-slim-down-automakers-still-hung-with-too-much-capacity.html.

[17] Interview, September 2011.

[18] Roger Cliff, Chad J. R. Ohlandt, and David Yang, Ready for Takeoff: China’s Advancing Aerospace Industry (Santa Monica, CA: RAND, 2011), 39, http://www.rand.org/pubs/monographs/MG1100.html.

[19] Mike Ramsey and Evan Ramstad, “Once a Global Also-Ran, Hyundai Zooms Forward,” Wall Street Journal, 30 June 2011, http://online.wsj.com/article/SB10001424052702303627104576413971267185128.html.

[20] CFM-Powered KC-135R Tanker Fleet Logs 11 Million Flight Hours,” SNECMA, 11 December 2007, http://www.snecma.com/cfm-powered-kc-135r-tanker-fleet,881.html?lang=en.

[21] TRs deploy once the main landing gear touches the tarmac, offering stopping power in addition to the brakes and flaps.

[22] Cliff, Ohlandt, and Yang, Ready for Takeoff: China’s Advancing Aerospace Industry, 42.

[23] The FAA handbook concerning how to supervise maintenance activities of airlines once an aircraft is fully developed itself runs to roughly one thousand pages.

[24] “Airliner Seat Maker Koito hit for Fabricating Fire-Resistance Data,” Kyodo News, 10 February 2010, http://search.japantimes.co.jp/cgi-bin/nn20100210a5.html; Mary Kirby, “Boeing Stops Offering Koito Seats to New Customers,” Flight Global, 7 February 2010, http://www.flightglobal.com/articles/2010/07/02/344008/boeing-stops-offering-koito-seats-to-new-customers.html.