China SignPost™ (洞察中国) #71—“Counting Cars: Rising Private Automobile Ownership in Chinese Cities Paves Road for Gasoline Demand”

Gabriel B. Collins and Andrew S. Erickson, “Counting Cars: Rising Private Automobile Ownership in Chinese Cities Paves Road for Gasoline Demand,” China SignPost™ (洞察中国) 71 (24 June 2013).

China SignPost™ 洞察中国–“Clear, high-impact China analysis.”©

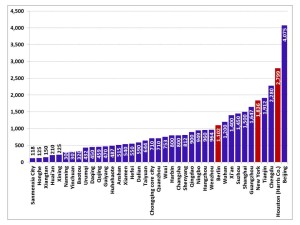

“Texas-sized” used to be the benchmark for large-scale car ownership, but “China-sized” is emerging as the new metric. We assembled statistical data for 36 cities that account for 30% of China’s 93 million-strong private passenger car fleet and found that Metro Beijing now has more than four million private passenger cars. That’s 45% more passenger cars than are registered in Harris County, Texas, home to car-crazy Houston and several of its major suburbs. At present, no Chinese metropolitan areas other than Beijing have attained Houston’s raw car ownership levels, but three Chinese metro areas now each have more private passenger cars than New York City, with its 1.8 million cars (Exhibit 1).

Exhibit 1: Private Passenger Car Ownership by Selected Metro Area in China and Abroad

Thousand vehicles

Note: For Chongqing “core city” is specified because the data provided are specific to the metro downtown. Chongqing municipality is much larger geographically than China’s three other provincial-level municipalities (Beijing, Shanghai, Tianjin), and the majority of its territory lies outside its central urban area.

Source: Municipal statistical bureaus, TexasSure, NYS DMV, China SignPost™ estimate

Why focus on private passenger car ownership in China? We do so for three core reasons. First, private passenger cars are sold and owned in far greater numbers than business-oriented private vehicles, accounting for roughly 80% of passenger cars in China, and thus constitute the largest piece of China’s gasoline demand pie. Second, sales and ownership of these cars are closely correlated with consumer economic activity and the economic well-being of China’s emerging consumer class. Third, ownership of private passenger cars creates a set of economic opportunities that China lacked until recently. Vehicle owners will need services and parts, roads to drive on, places to park, etc. Each link in this vehicular value chain creates direct opportunities for selling goods and services.

Greater use of cars and changing social attitudes regarding car use and ownership also hold significant potential to change basic life patterns in ways that meaningfully impact local economies. Consider the rural farming family who is finally able to purchase a small truck and can now drive goods directly to market instead of spending days waiting for a third party hauling service. This can help to improve China’s sluggish and uneven rural food distribution network, which still suffers significant losses from produce damage and spoilage. While such changes percolate unpredictably through societies as vehicle ownership rises, we believe passenger car ownership levels in key Chinese cities are reaching critical mass and becoming a force in their own right as car owners find new ways to use their prized steeds.

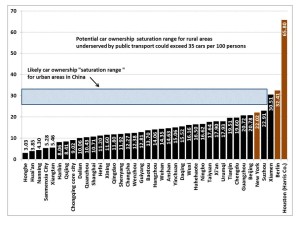

In per capita terms, Xiamen is China’s highest car ownership metro area at present, with 30.5 cars for every 100 residents (Exhibit 2). Guangzhou has a private passenger car ownership rate of just over 20 cars per 100 residents, close to that of Beijing. Suzhou, meanwhile, has an ownership rate of just under 23 cars per 100 residents. Such ownership levels are right on a par with New York City’s 22 cars per 100 residents.

We believe that a per capita private passenger car ownership rate of 25-30 cars per 100 residents is where most Chinese cities will reach a “saturation point” at which car ownership growth plateaus. Car ownership on Taiwan—the PRC’s closest global cultural analogue—has stabilized at approximately 31 cars per 100 residents and gives a sense of how car buyers may behave as some large costal mainland Chinese cities began to approach Taiwanese per capita wealth levels. Indeed, China’s wealthy coastal enclave of Xiamen—opposite Taiwan—now has a per capita private passenger car ownership rate of just under 31 cars per 100 residents.

Second, the car ownership levels seen in foreign cities such as New York and Berlin—which, like many large Chinese cities, have invested heavily in public transport and where cars are expensive to own—give a sense of where a saturation point might reasonably lie under broadly analogous physical conditions in large Chinese metro areas. Car ownership rates in rural China underserved by public transport could ultimately rise to roughly 35 cars per 100 residents.

Exhibit 2: Car Ownership per 100 Residents, By Metropolitan Area

Source: Municipal statistical bureaus, TexasSure, NYS DMV, China SignPost™ estimate

While China’s most widely recognized car owning cities are located on the country’s Eastern Seaboard, a significant number of large inland metro areas have per capita private passenger car ownership rates nearly as high as coastal cities’. For instance, Chengdu has car ownership rates of nearly 20 cars per 100 residents, while Urumqi and Xi’an each fall just shy of 18 cars per 100 residents.

Other large, booming inland cities have much lower ownership rates—12.27 cars per 100 residents in Changsha and 11.20 per 100 residents in Hefei. Most notably, populous areas that are predominantly rural in layout (the so-called Tier 3, 4 and 5 areas) tend to be poorer and typically have much lower rates of car ownership. If economic growth that drives personal incomes continues, these locales are likely to be centers of car sales growth moving forward.

For instance, Honghe in Yunnan Province presently has a car ownership rate of only 3.03 per 100 residents—less than half the national average rate for private passenger cars. Current sales trends indicate that the Honghe-type cities are already seeing significant car sales increases. The China Automobile Dealers Association says that in 2012 sales volumes increased by only single digits in the first-tier cities (albeit from a high baseline), but rose 131% in second and third-tier cities.

Evolving car ownership patterns

There appears to be a “fan out” effect where a region in China first sees car sales in its largest cities and then smaller municipalities also evolve into demand centers. For example, in 2006, Chengdu was home to 92.7% of Sichuan’s private passenger car fleet but now houses around 70% of the province’s private passenger cars, a clear sign that sales are taking off strongly in Sichuan’s smaller cities and townships. We expect such geographical diversification of sales to continue as places like Beijing and Shanghai enforce increasingly restrictive policies on car sales and use.

China’s domestic car brands already heavily focus their sales efforts on the smaller and inland cities and now the Western automakers and their Chinese JV partners are doing the same. For instance, GM plans to expand its dealership network in China by more than 34% by 2015, adding 1,300 additional dealerships and focusing much more heavily on Tier 3 and Tier 4 cities. Other carmakers are also striving to expand their sales networks in Central and Western China. In the near term, this sets dealers up for thinner margins and tough price competition. But in the three-to-five-year timeframe, growing dealer networks signify that, along with road and highway construction, the elements are aligning for a significant rise in car sales and ownership in China’s interior, a diverse region nearly as physically large as, and more populous than, the U.S.

What’s Motivating Chinese Car Buyers?

In China’s largest cities, car ownership has some practical benefits, but also comes with a significant set of financial and administrative headaches, as New Yorkers will thoroughly appreciate. For instance, researchers at the Centre for Global Engineering at the University of Toronto emphasize that Shanghai charges license fees as high as US$10,000 per vehicle, along with a 10% sales tax, and parking fees of up to US$10/hr in the city’s downtown. For a wealthy person driven by the social status conferred by owning an Audi or BMW, such costs are bearable. However, for a lower income buyer purchasing his/her first entry-level BYD sedan, costs of this level essentially erase the practical benefits of convenience in transportation that the car would otherwise confer.

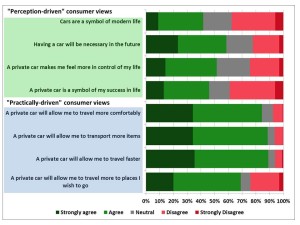

Car sales in China are driven by a mix of practical concerns, as well as considerations about how cars reflect social status. The best empirical data we could find from a Chinese source that speaks to what influences potential car buyers came from a team of researchers who obtained survey responses from 963 college students at Fudan University in Shanghai and Jiangsu University in Zhenjiang, Jiangsu.[1] Social status issues likely help seal the deal for many car sales—especially among young men on the make looking to impress prospective spouses—but, at least for survey respondents, social considerations still find many potential buyers in the “neutral” category, meaning car sellers must make persuasive marketing pitches.

On the other side of the ledger, the study suggests that potential car buyers’ opinions are more strongly formed with respect to the practical benefits of owning private cars. Indeed, no more than 8% of respondents chose “neutral” when asked about the practicality driven aspects of owning a car (Exhibit 3). Overall, for each of the four statements about practical benefits a car confers, the respondents overwhelmingly agreed or strongly agreed with the statement.

Exhibit 3: Prospective Chinese Car Buyers Driven By Practicality and Perceptions

Source: C. Zhu et al., Journal of Transport Geography

These students represent an analytically useful sample for a number of reasons. First of all, they represent a social cohort—future college graduates—who are on average more likely than less-educated members of society to attain an income level capable of supporting car ownership. Second, they are a representative slice of a large group, as China churns out just under seven million new university graduates each year.

Third, the students in the sample are a diverse group, both from the perspective of where they come from and in terms of their prior auto ownership experiences. At one end of the spectrum, roughly one-quarter hail from large cities, and of these 4 in 10 come from families who own cars. At the other end of the spectrum, 29% of the students come from small townships or rural areas, and of this group, fewer than one in twelve come from families who own cars. Most interestingly, despite the wide variance in prior personal experiences with cars, nearly 2/3 of the student respondents (65%) agreed that when they have the financial means, they will “definitely buy” cars, while only 14% disagreed with that statement.

Rubber Meets Road: Examining National and City-Level Gasoline Demand in China

Detailed academic studies conclude that Chinese cars consume 7.9 liters of gasoline per 100 km driven and that the average private passenger car in China travels in the neighborhood of 20,000 km each year.[2] The National Bureau of Statistics says that at year-end 2012, Chinese drivers owned just over 93 million private passenger cars. On this basis, China’s private passenger car fleet is likely consuming approximately 2.28 million bpd of gasoline at present.

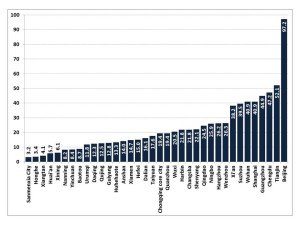

Examining gasoline demand by city helps to situate national gasoline demand hotspots relative to the country’s oil production, import, refining, and product transport infrastructure. Beijing leads Chinese private passenger car gasoline consumption at an estimated 97 kbd (Exhibit 4). Tianjin, Chengdu, and Guangzhou come next, at 65 kbd, 47 kbd, and 45 kbd, respectively.

To put these numbers into perspective, the thirstiest U.S. gasoline metropolis—Los Angeles—uses around 123 kbd of gasoline. Given that the majority of gasoline consumption is automotive, this suggests the average Beijinger uses around 15% less gasoline than the average Angeleno and around 60% less than the average Houstonian. On this basis, the total and per capita passenger car ownership rates and gasoline consumption figures in large Chinese cities suggest that even with saturation points significantly lower than those found in the U.S. or Europe, Chinese gasoline and crude oil demand still has meaningful room to grow.

Exhibit 4: Estimated Private Passenger Car Gasoline Use by Selected Metro Area

Thousand bpd

Note: For Chongqing “core city” is specified because the data provided are specific to the metro downtown. Chongqing municipality is much larger geographically than China’s three other provincial-level municipalities (Beijing, Shanghai, Tianjin), and the majority of its territory lies outside its central urban area.

Source: Municipal statistical bureaus, Energy Policy, China SignPost™ estimate

Within China’s gasoline market, locations poised for significant demand growth include heavily populated inland provinces such as Hunan, Henan, and Hubei, as well as myriad Tier 3, 4, and 5 cities across the country. For instance, Yunnan Province—home to 46 million people—saw its oil products demand, which is more than 90% gasoline and diesel fuel, rise from 8.5 million tonnes in 2011 to more than 10 million tonnes in 2012. Demand is expected to reach 14 million tonnes per year by 2015.

If the inland cities shown in Exhibit 4 each experienced a 50% increase in gasoline demand in the next several years, China’s passenger car gasoline consumption would rise by 570 kbd or 25% above the present level. This number is reasonable in light of the 15% and higher annual growth rates in private passenger car ownership in many of the cities covered. Moreover, Exhibit 4 only captures a snapshot of the hundreds of small and medium-sized Chinese cities that will drive car ownership growth as China’s 7,200+ car dealerships compete to outsell each other in coming years.

The Road Ahead

Future passenger car fleet growth in China will hinge upon Three Ps:Perception, practicality, and policy. The effects that perception and practicality concerns have on potential car buyers in China are discussed at length above. Policy is a major wildcard, as the level of permissiveness or restrictiveness cities maintain toward car sales and ownership will play a pivotal role in determining consumers’ car acquisition activity, particularly in lower reaches of the income spectrum.

Academic researchers have shown the elasticity of 3.6 between increases in GDP and rises in car ownership in Beijing, which until the five years ago maintained a permissive regime towards car owners.[3] Shanghai, in contrast, has applied tough measures to constrain car sales and has an elasticity of only 1.0 between GDP increases and car ownership increases.[4] Shanghai’s policies have skewed car ownership in favor of business vehicles, as opposed to private passenger cars. When people do purchase passenger cars, they tend to be higher-end models because less-well-off car buyers are effectively priced out of the market by high license plate fees and other barriers.

Evidence suggests inland cities may be more willing than their coastal cousins to tolerate car congestion and pollution as a price of development. Xi’an, which is rapidly becoming one of China’s largest car-owning cities, had planned to emulate Beijing. Shanghai, and Guangzhou and restrict license plate issuance to control car fleet growth, but had to rescind the plan in August 2012 following vociferous public outcry against the proposed restrictions. To be sure, not all inland cities share Xi’an’s attitude. Guiyang, Guizhou Province’s capital, has restricted license plate issuancesince summer 2011 despite public outcry, but does offer an unlimited number of plates for drivers willing to forego entering the city’s downtown.

Car sales in China’s Tier 3, 4 and 5 areas are likely to have GDP elasticities exceeding 3.0

The combination of the Xi’an approach, which allows unrestricted growth in car ownership, and the Guiyang approach, which only affect drivers wishing to use their vehicles in the city’s core, point to a future in which vehicle ownership in China’s interior has a Beijing-style elasticity of around 3.5 to GDP growth. Under such conditions, even if China’s economic growth were to slow significantly, many areas could still see double digit annual car sales increases.

Used Cars Will Also Gradually Help Drive Higher Car Ownership Levels

As China’s private passenger car fleet grows, vehicles age, and owners look to trade up, the country’s used car market is likely to expand, which provides an additional channel for lower income consumers to become car owners. Wealthier consumers buying new cars and allowing their old models to percolate through the market as used vehicles is only a nascent factor at present, as China’s used car market remains small—1.25 million vehicles sold in 2012, according to the China Automobile Dealers Association.

That said, used car sales are likely to substantially increase in the next 2-3 years as cars sold during the stimulus-fueled car sales boom in 2009-10 age sufficiently that their original owners seek to trade up for newer models. Moreover, cultural factors that place a premium on ownership of new cars are already clearly visible in South Korea and Taiwan; upper class mainland Chinese can be expected to mirror such trends as their wallets allow.

A Chinese government eager to prop up economic growth and local governments keen to boost local manufacturers and joint ventures are likely to cultivate such societal preferences. A mature auto market such as the U.S. will have used car sales volumes that are 2.5-3.0 times larger than new car sales. China is many years away from this, but within three years, we expect used car transactions to reach 5-6 million per year.

Commodity impacts

Chinese private passenger car fleet growth is very positive for gasoline demand. We estimate that each million new cars sold in China creates 20 kbd of gasoline demand. Based on the average gasoline yields of Sinopec and PetroChina’s refineries, approximately 100 kbd of crude oil are needed to produce 20 kbd of gasoline.

Even lower-end cars will still have substantial gasoline and crude oil market impacts. Carmakers are tailoring their product portfolios in inland parts of China to match offerings to lower income ranges than will be found in wealthier coastal areas. However, a car in Xiangtan, Hunan whose sticker price is 30% lower than a fancier model sold in Shanghai will in many cases still use approximately as much gasoline as its upmarket counterpart. Options and fancy styling consume a lot more money in terms of sticker price, but don’t usually enhance gasoline consumption significantly unless the upmarket vehicle uses a substantially larger engine. However, as more used cars penetrate lower tiers of the market and wealthier consumers upgrade to larger, thirstier SUVs, the net increases in car ownership stand to drive increased gasoline demand.

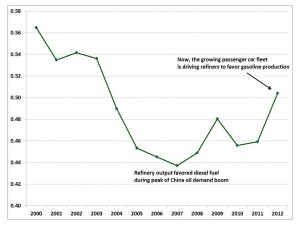

China’s rising passenger car ownership is reshaping how the country’s refiners operate. During the peak of China’s emergence as a major global oil consumer between 2004 and 2007, refiners worked to favor diesel fuel, which was badly needed to run trucks, earthmovers, and generator sets that kept factory lights on when the power grid overloaded (Exhibit 5). A significant tipping point came in 2012, when Sinopec and PetroChina, the country’s two largest oil refiners, began shifting their output slates back toward the gasoline craved by China’s burgeoning private passenger car fleet.

Exhibit 5: Sinopec and PetroChina Are Once Again Favoring Gasoline Production

Barrels of gasoline produced per barrel of diesel fuel produced

Source: Company Reports, China SignPost™ analysis

Other Commodities Positioned to Benefit

As increased car numbers drive greater gasoline demand, they also increase demand for natural and synthetic rubber as cars require original tires when produced, and periodic replacements thereafter.

China’s moves to implement Euro 4 and Euro 5 emission control standards on cars also bodes well for producers of platinum group metals such as platinum, palladium, and rhodium, which are used on automobile exhaust catalysts. In this area, the chronic instability in the mining sector of South Africa—the world’s largest PGM producer—bears close attention.

Wild Cards Affecting Investment Risk

- What proportion of emerging auto market cities will impose restrictive policies vis-à-vis current and aspiring car owners? While cities like Xi’an are adopting relatively laissez faire policies toward private auto ownership, other emerging car markets such as Shijiazhuang are planning to impose restrictions on ownership and use of private passenger cars within the next year.

- Will Chinese car buyers become more willing to buy on credit? When one of the authors visited a BYD Dealership in Shanghai in 2010, the salespeople told him that the vast majority of buyers paid cash for their vehicles. Gathering up US$10,000 or more in cash for a car purchase is a tall order. As such, using at least some degree of financing could effectively enable the millions of Chinese who have decent disposable incomes, but may not have this level of cash, to begin accessing the lower end of the car market. A number of our contacts in China say that face-conscious Chinese consumers prefer new vehicles and that they like to buy the very best they can afford. This demand pattern was dramatized to one of the authors in 2011 when he visited Bentley and Lamborghini dealerships in Qingdao and was informed of the companies’ extensive national networks, which today cover 35 and 18 cities respectively.

Greater use of financing plans such as those widely used in the U.S. could significantly expand the horizon of opportunity for many prospective car buyers; the question is whether these consumers will be willing to assume meaningful levels of debt. China’s rising credit card ownership suggests consumers might be more willing to assume debts than before, as the country’s number of credit cards in circulation rose 16% year on year in 2012 to 331 million cards. But by the same token, card users’ behavior appears relatively debt averse. Chinese cardholders tend to pay off their balances more quickly than Americans, with only 3% to 8% of cardholders rolling over balances and incurring interest charges, as opposed to 40% of American credit card holders.

- Will car ownership undermine use of widely available public transport in larger cities? The answer to this question will depend largely on whether individual buyers are purchasing cars for practical or perception reasons (i.e., because everybody else is doing so). For a person living well inside the core city, public transport is certainly cheaper than car travel; and in the more congested cities, is also likely faster between points than driving one’s own car would be.

- Will higher levels of car ownership shift Chinese long-distance travel culture away from railways? The idea of “road trips” that is so popular in North America is not widely shared in China, but as highway infrastructure between cities improves and more people own cars, this could change meaningfully. For trips that would require more than several hours of driving, we believe the wealthier consumers will choose to fly and middle class and below, even if they have a car, would find it cheaper and more convenient to travel by rail.

- Will a Chinese analog to Zipcar emerge? Zipcar says each one of its cars can replace 20 privately-owned ones. If social perception reasons are the root driver of car purchases, the emergence of a popular Chinese membership-based car sharing company is unlikely to undermine demand growth. If practical demands (i.e., transporting personal items on an irregular basis) predominate, however, then this could have a major impact in congested Chinese cities in which car ownership may be expensive and inconvenient.

- Will alternative vehicles (e.g., electric vehicles and natural gas-powered vehicles/NGVs) make substantial inroads into the passenger car market?At this point we believe that NGVs will primarily be used a taxis and fleet vehicles due to logistical challenges of obtaining natural gas fuel and the cost of converting gasoline powered cars to run on NG, but more generous government incentives to adopt NGV could change this. Similar dynamics would likely apply to electric vehicles, which might also be promoted by government policies designed to support Chinese companies attempting to capture share of an emerging green vehicle market.

Additional information:

- Gabriel B. Collins and Andrew S. Erickson, “Downturn to “New Normal”? China’s Consumer Economy is Rolling Over and Sales of Chicken, Cars, and Shoes Are Taking a Hit,” China SignPost™ (洞察中国) 60 (1 August 2012).

- Gabriel B. Collins and Andrew S. Erickson, “Electric Bikes are China’s Real Electric Vehicle Story,” China SignPost™ (洞察中国) 49 (7 November 2011).

- Gabriel B. Collins and Andrew S. Erickson, “The 10 Biggest Cities in China That You’ve Probably Never Heard of,” China SignPost™ (洞察中国) 37 (1 June 2011).

- Gabriel B. Collins and Andrew S. Erickson, “Chinese Now Pay 33% More for Gasoline and 16% More for Diesel Than Americans,” China SignPost™ (洞察中国) 23 (21 February 2011).

- Gabriel B. Collins and Andrew S. Erickson, “Counting the Barrels: Heavy Truck Sales are a Better Barometer Than Car Sales of China’s Oil Demand Growth,”China SignPost™ (洞察中国) 20 (31 January 2011).

- Gabriel B. Collins and Andrew S. Erickson, “Dying for a Spot: China’s Car Ownership Growth is Driving a National Parking Space Shortage,” China SignPost™ (洞察中国) 17 (10 January 2011).

About Us

China Signpost™ 洞察中国–“Clear, high-impact China analysis.”©

China SignPost™ aims to provide high-quality China analysis and policy recommendations in a concise, accessible form for people whose lives are being affected profoundly by China’s political, economic, and security development. We believe that by presenting practical, apolitical China insights we can help citizens around the world form holistic views that are based on facts, rather than political rhetoric driven by vested interests. We aim to foster better understanding of key internal developments in China, its use of natural resources, its trade policies, and its military and security issues.

China SignPost™ 洞察中国 founders Dr. Andrew Erickson and Mr. Gabe Collins have more than a decade of combined government, academic, and private sector experience in Mandarin Chinese language-based research and analysis of China. Dr. Erickson is an Associate Professor at the U.S. Naval War College’s China Maritime Studies Institute (CMSI) and an Associate in Research at Harvard’s John King Fairbank Center for Chinese Studies. Mr. Collins is a law student at the University of Michigan Law School. His research focuses on commodity, security, and rule of law issues in China, Russia, and Latin America.

The positions expressed here are the authors’ personal views. They do not represent the policies or estimates of the U.S. Navy, the U.S. Government, or any other organization. The authors have published widely on maritime, energy, and security issues relevant to China. An archive of their work is available at www.chinasignpost.com.

[1] Charles Zhu, Yiliang Zhu, Rongzhu Lu, Ren He, Zhaolin Xia, “Perceptions and Aspirations for Car Ownership among Chinese Students Attending Two Universities in the Yangtze Delta, China,” Journal of Transport Geography 24 (2012) 315-25.

[2] Hong Huo, Zhiliang Yao, Kebin He, and Xin Yu, “Fuel Consumption Rates of Passenger Cars in China: Labels vs. Real World,” Energy Policy 39 (2011): 7130-35.

[3] Han Hao, Hewu Wang, and Mingyao Ouyang, “Comparison of Policies on Vehicle Ownership and Use Between Beijing and Shanghai and Their Impacts on Fuel Consumption by Passenger Vehicles,” Energy Policy 39 (2011): 1016-21.

[4] Han Hao et al.