China SignPost™ (洞察中国) #84: “Tank Watch: What Do China’s November 2014 SPR Data Tell Us?”

Gabriel B. Collins and Andrew S. Erickson, “Tank Watch: What Do China’s November 2014 SPR Data Tell Us?” China SignPost™ (洞察中国) 84 (24 November 2014).

On November 20, China’s National Statistics Bureau unveiled a G-20 surprise by publishing inventory data for four of the country’s strategic petroleum reserve (SPR) sites: Dalian, Huangdao, Zhenhai, and Zhoushan. These four sites can store approximately 103 million barrels of crude combined. The reported crude inventory level on November 20 was 89.5 million barrels, yielding an average capacity utilization rate of just under 87%.

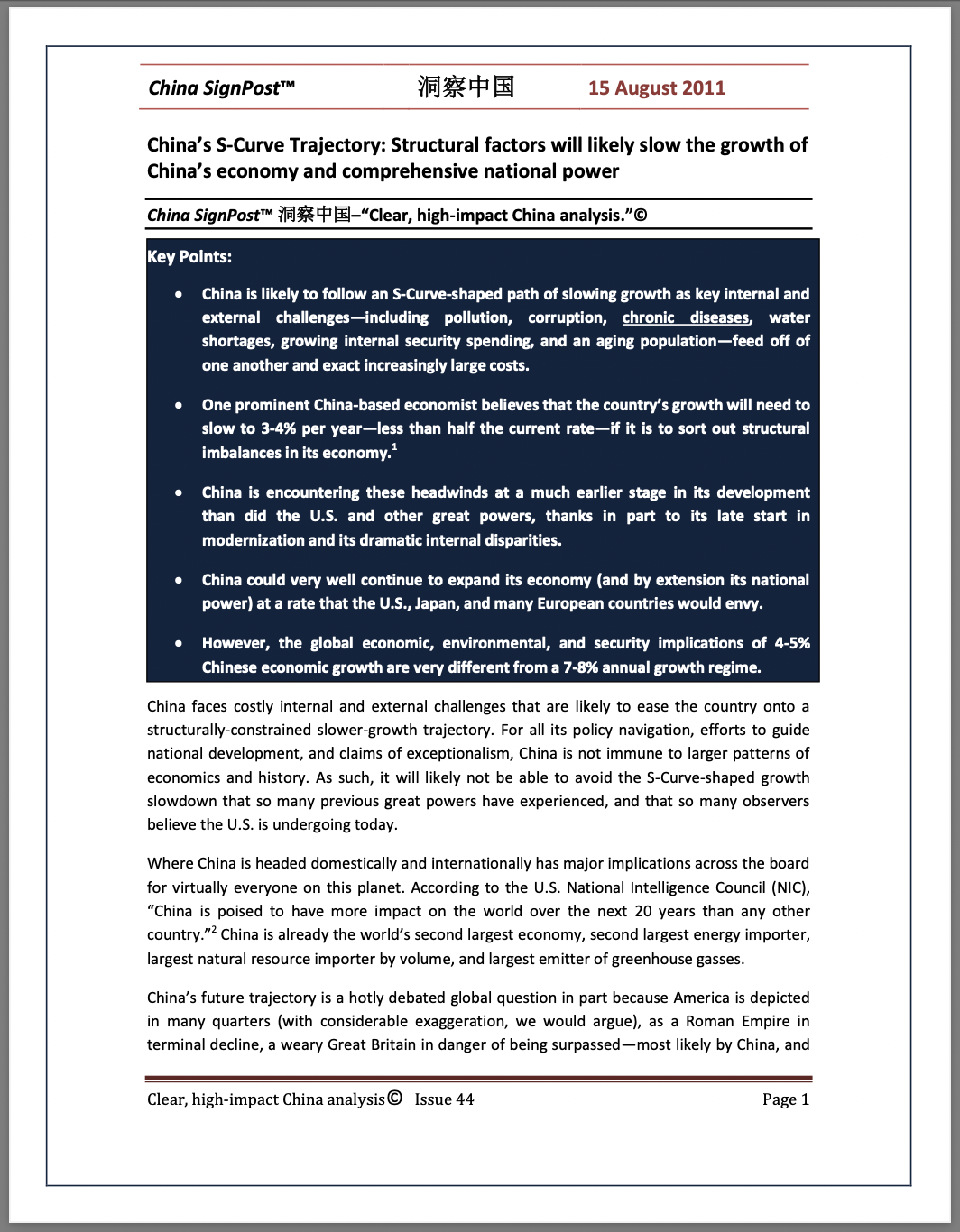

The capacity utilization by site varies, with Dalian at 82.8%, Huangdao at 89.4%, Zhenhai at 83.2%, and Zhoushan at 91.1%. These utilization rates are significantly lower than the U.S. SPR, which between January 2007 and the present has averaged a 97% capacity utilization rate and never dropped below 94% utilization (Exhibit 1).

Exhibit 1: China’s November 20, 2014 SPR Utilization Rates vs. US SPR Utilization Rates Since January 2007, % of total capacity in use

Source: DOE, EIA, NBS China, China SignPost™ analysis

We choose the U.S. as a basis for comparison because: (1) together with China, it constitutes the “G-2” of global oil consumption, (2) the U.S. now has decades of SPR management experience under its belt, and (3) the countries have different economic structures and geological characteristics (e.g., U.S. salt domes) that shape their SPR management approaches.

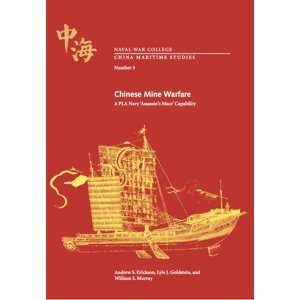

It is likely that crude oil has a lower “dwell” time and higher turnover ratio in the Chinese SPR system, driven in part by the fact that SPR and “commercial” storage are closely co-located and are likely frequently commingled in practice. For instance, the Zhenhai storage site near Ningbo has 52 tanks which are located immediately next to commercial tank farms of 20 tanks and 26 tanks, whose combined capacity approaches that of the SPR facility itself (Exhibit 2). In addition, Sinopec revealed in 2007 that it had “rented” storage space in the Zhenhai SPR facility, so there is a precedent for commercial use of SPR tankage in China.

Exhibit 2: Zhenhai SPR Imagery Shows Co-Location of “Strategic” and “Commercial” Storage

Source: Google Earth, China SignPost™ analysis

Additional data points will be required to understand China’s SPR management philosophy more comprehensively. The data we hope to see China disclose would include additional statistical data of inventory levels over time, as well as publication of inventory data from inland SPR sites such as Lanzhou and Dushanzi.

While conclusions are very preliminary, two key facts suggest that China’s SPR may be managed quite differently than its American counterpart. First, these reserve sites have all been operating since 2009 and have had ample time to fill up to full capacity, were that the operator’s objective. Second, oil prices have declined sharply and offer lower cost filling opportunities. In practical terms, 10 Suezmax cargoes or 5 VLCCs’ worth of crude injections would bring the four Chinese SPR sites’ storage capacity utilization to the average U.S. level.

Bottom Line: Several further SPR data disclosures will enable us to draw firmer conclusions, but it already appears likely that China is managing its SPR is a dynamic, quasi-commercial fashion more akin to South Korea’s “time swap” system in which commercial crude users can “borrow” oil from strategic reserves so long as they return an equal amount within a set period. As such, China oil use forecasts will need to assume that SPR injections will often be “lumpy” and volatile, with fundamental oil demand, internal refinery operation decisions, and global crude pricing all influencing SPR fill and drawdown decisions.