Does China Have an Aging Problem? Yes, a China-sized One! Staggering Specifics from Dr. Huang Yanzhong & CSIS’s ChinaPower Project

China’s rapid aging and increasingly-imbalanced demographics will increasingly represent a headwind and downside risk on major aspects of its development and accretion of national power.

Read this seminal multimedia report to learn more about these pivotal population trends:

“Does China Have an Aging Problem?” ChinaPower, Center for Strategic & International Studies, 21 April 2016.

http://chinapower.csis.org/aging-problem/

Key Excerpts:

China’s population is growing old at a faster rate than almost all other countries. …

This trend is particularly worrisome for China, as its development is tied to its demographic advantages. For decades, China reaped the benefits of a demographic dividend that supplied a young workforce for its manufacturing sector, which enabled China to emerge as a global economic power. Furthermore, China’s demographic shift presents significant social problems. The number of Chinese retirees will soon skyrocket, prompting questions of China’s preparedness to provide senior care. The one-child policy also contributed to a significant gender imbalance among China’s younger population, as some women elected to have sex-selective abortions to ensure that their only child was male. China’s leaders now face a challenge of reaffirming China’s economic power while addressing prevailing social issues. …

“Ultimately, aging will change the societal intergenerational relationships pitting the economic productive young people against those who are benefitting from social security and medical care payments. A confrontation between workers and retirees will likely arise.” –HUANG YANZHONG

Analyzing China’s shifting demographics through comparison with other countries highlights the extent of China’s aging problem. … China… has begun the aging process at an earlier stage of development, and at a more accelerated pace than most countries have experienced. …

As China will age more rapidly than India in the coming decades, it is possible that India will reap a “demographic dividend,” where the proportion of the working population in India will increase relative to China. In absolute terms, India’s working-aged population is expected to surpass China’s between 2020 and 2030. This could lead to a shift in manufacturing jobs from China to India, a sector in which India has traditionally lagged. …

China is aging at a rate that few countries have matched historically. …

China at present lacks many of the welfare capabilities that have aided developed nations during their demographic transition. …

Click here to watch an interview with Dr. Huang Yanzhong: “Does China Have an Aging Problem?”

WHAT DOES ALL THIS MEAN? IT MEANS THAT CHINA IS FACING AN S-CURVED SLOWDOWN IN THE RATE OF NATIONAL DEVELOPMENT AND POWER ACCRETION, AS WELL AS ATTENDANT DOWNSIDE RISKS, SOONER THAN OTHER GREAT POWERS THAT EXPERIENCED SUCH HEADWINDS AND SLOWING TRAJECTORY EARLIER IN HISTORY. FURTHER CONTEXT:

Council on Foreign Relations Rates “China’s S-Shaped Threat” a “Must Read”

Andrew Erickson and Gabe Collins, “China’s S-Shaped Threat,” The Diplomat, 6 September 2011, designated a “Must Read” by the Council on Foreign Relations.

Analysts of international relations have focused lately on China’s potential challenges to the international system. But China’s greatest challenges may in fact be internal. The implications will be significant.

China is assumed by many to be destined to overtake the US as the world’s leading power. But history shows the dangers of extrapolating from today’s growth numbers.

According to the US National Intelligence Council (NIC), ‘China is poised to have more impact on the world over the next 20 years than any other country.’ China is already the world’s second largest economy, second largest energy importer, largest natural resource importer by volume, and largest emitter of greenhouse gasses. Indeed, following the S&P downgrading of the US credit rating to AA+, Beijing feels empowered to declare that it ‘has every right now to demand the United States to address its structural debt problems.’

However, despite its astute policy navigation, efforts to guide national development, and claims of exceptionalism, China isn’t immune to larger patterns of economics and history. And those patterns tell us that China faces costly internal and external challenges that will hinder its ability to avoid the S-Curve-shaped growth slowdown that so many previous great powers have experienced, and that so many observers believe the United States is undergoing today.

Where China is headed domestically and internationally has major implications across the board for virtually everyone on this planet. The country has risen at a rate beyond even its leaders’ expectations over the past three decades, and a power shift is afoot in the international system. The fully unipolar system that persisted from 1989 to roughly 2008 is no more. To many, this signals a clear power transition in which China is poised to overtake the United States as the world’s foremost power. Estimates emerge constantly as to when China’s economy will become larger than that of the United States, and it’s assumed that China’s diplomatic, information, and military aspects of national power will grow in proportion.

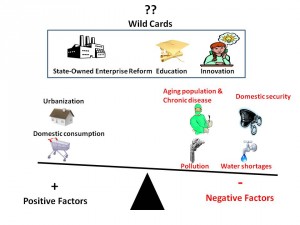

But many policymakers and economists question whether China’s current growth trajectory can be maintained in the face of clear structural challenges that include pollution, corruption, chronic diseases, water shortages, growing internal security spending, and an aging population—all factors that feed off of one another and exact increasingly large costs for the Chinese state and economy. …

For the article cited by the Council on Foreign Relations, see Andrew S. Erickson and Gabriel B. Collins, “China’s S-Shaped Threat,” The Diplomat, 6 September 2011.

FOR THE FULL-LENGTH REPORT ON WHICH THE ABOVE PIECE IS BASED, SEE:

Gabriel B. Collins and Andrew S. Erickson, “China’s S-Curve Trajectory: Structural factors will likely slow the growth of China’s economy and comprehensive national power,” China SignPost™ (洞察中国) 44 (15 August 2011).

China SignPost™ 洞察中国–“Clear, high-impact China analysis.”©

Key Points:

–China is likely to follow an S-Curve-shaped path of slowing growth as key internal and external challenges—including pollution, corruption, chronic diseases, water shortages, growing internal security spending, and an aging population—feed off of one another and exact increasingly large costs.

–One prominent China-based economist believes that the country’s growth will need to slow to 3-4% per year—less than half the current rate—if it is to sort out structural imbalances in its economy.[1]

–China is encountering these headwinds at a much earlier stage in its development than did the U.S. and other great powers, thanks in part to its late start in modernization and its dramatic internal disparities.

–China could very well continue to expand its economy (and by extension its national power) at a rate that the U.S., Japan, and many European countries would envy.

–However, the global economic, environmental, and security implications of 4-5% Chinese economic growth are very different from a 7-8% annual growth regime.

China faces costly internal and external challenges that are likely to ease the country onto a structurally-constrained slower-growth trajectory. For all its policy navigation, efforts to guide national development, and claims of exceptionalism, China is not immune to larger patterns of economics and history. As such, it will likely not be able to avoid the S-Curve-shaped growth slowdown that so many previous great powers have experienced, and that so many observers believe the U.S. is undergoing today.

Where China is headed domestically and internationally has major implications across the board for virtually everyone on this planet. According to the U.S. National Intelligence Council (NIC), “China is poised to have more impact on the world over the next 20 years than any other country.”[2] China is already the world’s second largest economy, second largest energy importer, largest natural resource importer by volume, and largest emitter of greenhouse gasses.

China’s future trajectory is a hotly debated global question in part because America is depicted in many quarters (with considerable exaggeration, we would argue), as a Roman Empire in terminal decline, a weary Great Britain in danger of being surpassed—most likely by China, and even an over-extended and over-militarized Soviet Union that faces devastating collapse if it fails to reorder its priorities drastically.

In a recent speech, China expert Ambassador Chas Freeman, President Nixon’s interpreter during his 1972 visit to China, declared: “The balance of prestige, if not yet the balance of power, between the United States and China has shifted… In some disturbing ways, Sino-American competition is beginning to parallel the contest between us and the Soviet Union in the Cold War. This time, however, the United States is in the fiscally precarious position of the USSR, while China plays the economically robust role we once did.”[3]

These historical analogies gain traction because relevant patterns may be discerned in history, most famously by Paul Kennedy in The Rise and Fall of the Great Powers. Kennedy claimed that a declining “Great Power is likely to find itself spending much more on defense than it did two generations earlier, and yet still discover that the world is a less secure environment—simply because other Powers have grown faster, and are becoming stronger….”[4] Sound familiar?

Indeed, the S&P has downgraded the U.S. credit rating from the AAA level it held for 70 years down to AA+ with a negative outlook, and Beijing is lecturing the U.S. to protect its investments. In a strongly worded editorial on 6 August 2011, Xinhua, one of China’s main state-controlled media entities, declared that “China, the largest creditor of the world’s sole superpower, has every right now to demand the United States to address its structural debt problems and ensure the safety of China’s dollar assets.”[5]

China has risen at a rate beyond even its leaders’ expectations over the past three decades and a power shift is afoot in the international system. The fully unipolar system that persisted from 1989 to roughly 2008 is no more. To many, this signals a clear power transition in which China is poised to overtake the United States as the world’s foremost power.

Estimates emerge constantly as to when China’s economy will become larger than that of the U.S., and there are larger assumptions that China’s diplomatic, information, and military aspects of national power will grow in proportion. Proponents of this view may cite predictions like those made by Goldman Sachs and PricewaterhouseCoopers, which predicted that China’s GDP would exceed that of the U.S. by 2027 and 2020, respectively.[6] Here it is worth noting that Goldman’s newer number is a revised forecast based on the firm’s original view, expressed in 2003, that China’s GDP would surpass that of the U.S. in 2041.[7]

Yet at workshops, policymakers’ offices, and water coolers around the world, a substantial portion of discussions revolve around a more immediate question: “by how much is China’s economic growth going to drop in 2011?” One prominent China-based economist believes that the country’s growth will need to slow to 3-4% per year—less than half the current rate—if it is to sort out structural imbalances in its economy.[8]

This consensus has important implications for near-term economic policies and financial asset allocation decisions, as continued weak U.S. growth, an ongoing debt crisis, and an earthquake-weakened Japan leave China as the single main financial engine that could help sustain global economic growth. Yet China also faces a litany of problems and itself is already highly extended on its own stimulus plans, which were implemented in response to the 2008 global financial crisis. Beijing’s criticism of current events in the U.S. is reasonable and understandable, but the leaders in Zhongnanhai face a range of equally pressing, if not larger structural challenges to growth and development in their own country. Indeed, this is likely part of the reason—propaganda opportunities aside—that China is so concerned about what happens in the U.S., given the potential impacts on China’s own growth.

The ever-increasing importance for China as a global economic and political player raises a larger, and far more fundamental, question: “are China’s economy and national development following an S-Curve trajectory that will bring slowing growth rates in coming years?” Manifold internal and external challenges China faces are likely to increasingly become headwinds for growth. Despite the skill and will of China’s leadership to keep the country on a robust growth course, the fundamental nature of many of these issues make it seem ever-more-likely that China may be easing onto a structurally-constrained slower-growth trajectory.

In its early years of modernization, China exploited low labor costs and initial infrastructure investment to grow rapidly but is beginning to assume social welfare and international burdens that will likely slow growth progressively and may even check China’s rise in the international system as its leaders are forced to make much more difficult sets of “guns vs. butter” decisions.

China’s unfolding confluence of factors that may retard national development is especially noteworthy given the country’s massive size and global importance and because China is encountering these headwinds at a much earlier stage in its development than did the U.S. and other great powers, thanks in part to its late start in modernization and its dramatic internal disparities.

China could very well continue to expand its economy (and by extension its national power) at a rate that the U.S., Japan, and many European countries would envy. However, the global implications of 4-5% Chinese growth, with considerable risks that are shifting from upside to downside[9] virtually across the board, are very different from a 7-8% annual growth regime. As such, we hope to catalyze useful discussion on how to cope with a lower-growth S-Curve future that could be very different from the optimistic straight-line growth projections that dominate current views of China.

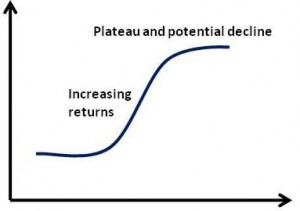

What is an S-Curve?

The S-Curve concept comes from a mathematical model that was later applied to other fields including physics, biology, and economics, to show how entities’ growth patterns typically change over time. In his seminal work War and Change in World Politics, Robert Gilpin uses the concept of an S-Curve to describe how great powers rise and decline.[10] He argues that a state must inevitably decline because of an historical tendency for national efficiency to decrease as society ages, thereby creating a downward spiral of increasing consumption and decreasing investment that undermines the economic, military, and political underpinnings of a state’s international position. A society or country experiences slow growth at its inception, then enjoys more rapid growth as more resources flow into the state treasury.

The process continues until the state reaches its maximum growth rate, an inflection point at which various countervailing forces begin to constrain expansion and set the economy onto a slower growth path or even a state of equilibrium. Domestically, social spending and rent seeking behavior may threaten productive investment and economic growth. Internationally, a hegemon tends to ‘overpay’ for influence in the international system because of the tendency for allies to ‘free-ride,’ and the inherent propensity toward technological diffusion may threaten to undermine a hegemon’s economic and technological leadership. But differences in national system and circumstances may have profound implications for the creation and maintenance of national power.

Rather than using Gilpin’s observation and the S-Curve pattern as iron laws, it is more instructive to use them as conceptual lenses with which to examine the potential future trajectory of great powers. Indeed, business authors point out that companies can undergo multiple S-Curve development cycles and there is no reason in theory why a country could not do the same.[11] However, for a nation-state, such a rebirth typically takes decades if it happens at all, especially in one as large and diverse as China. Exhibit 1 (below) shows an S-Curve trajectory for national development.

Exhibit 1: National Development S-Curve Schematic

Many have argued recently that S-Curve-like factors such as explosive growth in healthcare and pension costs and military/overseas commitments threaten American prosperity and preeminence, but few have considered the possibility that similar factors could constrain China—and perhaps much sooner than commonly anticipated.

China’s countervailing forces are not deterministic, but managing them will require major shifts in the country’s economic, and perhaps, political structure. This may substantially constrain the country’s potential economic growth and proportionately, its ability to invest in education, innovation, the military, and other factors that help determine a country’s comprehensive national power.

This analysis divides key challenges that China faces into the following categories: political, demographic, structural, economic, and security. We follow this order because the political system’s prior emphasis on ‘growth first, other things second’ helped produce a variety of the structural issues discussed below (such as high incidences of cancer and other chronic diseases), as well as the economic issues (such as local governments’ use of debt), and because civilian and military officials decide China’s military strategy and then have to find ways to pay for it, taking into account the financial environment in which they are, and will be.

A key point here is that these problems do not occur in isolation. Rather, they interact as a dynamic system and have real potential to be mutually reinforcing. For example, if the high local government debts end up yielding a large pool of non-performing loans that require the central government to liquidate them, that would effectively remove funds that could otherwise have been used to address chronic diseases or invested in value-accretive items such as education, research and development, or the Chinese military.

Exhibit 2: Key Factors that are Tipping China’s Economic Growth Scale

Political Issues

Official views of growth. China’s leaders are struggling to balance growth and social stability. Foreign analysts should consider the possibility that a substantial portion of Chinese leaders, especially at the national level, may privately welcome a shift to a structurally lower, but still robust growth path that emphasizes quality of development as opposed to sheer quantity of GDP. The new 5-Year Plan’s target of 7% annual GDP growth,[12] in contrast to the previous 7.5% annual growth benchmark, suggests shifting internal perceptions regarding the importance of balancing quality and quantity of economic growth.[13]

For a central government with a long-term development strategy, 20 years of steady and slower economic growth could potentially be a more attractive path than five years of above-target annual growth followed by 15 years of slow growth as unchecked pollution, chronic health issues, and other sustainability challenges exact a toll. Stable, medium-paced growth potentially offers a brighter future for China than overheated growth that creates boom-bust dynamics. A local official attempting to get promoted to the next level, by contrast, is judged on short-term growth just as an American corporation is preoccupied with quarterly profits, often at the expense of long-term strategy. Herein lies one of China’s most intractable governance challenges.

Potential Political Evolution

China’s leadership is becoming increasingly pluralistic, with each successive leadership transition creating more of an oligopoly; as opposed to a virtual monopoly in which one paramount leader like Mao Zedong or Deng Xiaoping could steer the country largely by himself. The Communist Party retains an absolute hold on political power, but there is a rising probability that coming years could see a transition into a leadership that is still authoritarian in many respects, but which more explicitly bases its legitimacy on a mix of technical competence and nationalism and allows for more pluralistic expression and consideration of policy suggestions, at least within government channels.

Of course, if such approaches fail to satisfy the ever-higher demands of public opinion, it is always possible that political change could occur more rapidly, and perhaps in a more disruptive manner. Political unrest might also materialize in specific areas, spurred by ethno-religious disaffection in Xinjiang or Tibet, or in response to a variety of other concerns there and elsewhere. No matter what the ultimate course, it seems likely that a broader range of political movements and viewpoints will find their expression in Chinese politics over time.

If China’s popular press and web discussions are any indicator of broader public sentiment, a political pluralization that allows more competing views to vie for influence may initially increase nationalism and see it expressed in aggressive and assertive ways, as happened with the U.S. via the Yellow Press during the 1890s and through military and police actions in the Caribbean in the late 19th and early 20th century. History suggests much to worry about in this regard.

However with the passage of time, sometimes several decades, a nation that has transitioned to a more diverse political system will have arguably a greater chance of being stable, predictable, and “responsible” in its policies toward is neighbors, etc.—perhaps because its leaders, who must compete for public support, may face more checks and balances in spending their subjects’ blood and treasure; and national security policies, while sometimes harder to arrive at consensus on, will tend to be more reliable and durable over time because they reflect greater citizen support.

Demographic Issues

People matter, and so too do population trends, which are typically decades in the making and take equally long to reverse (if they can be at all in a relatively developed ‘post-Modern’ society), particularly in a country like China that does not have, and likely cannot accept, significant immigration to help rebuild the population. Demographic decline may enhance China’s domestic manifestation of Gilpin’s pattern. By ca. 2030-35 in even the most optimistic estimates, China will start aging to such a degree as to call any straight-line projections of its economic growth and other national power trends into serious doubt.

As demographer Nicholas Eberstadt relates, “China has been a sub-replacement society for perhaps twenty years [with a] current net replacement rate (NRR) [of] just 0.77, and some authoritative estimates suggest that it could be even lower than this.”[14] China’s population of young male manpower (ages 15-24) has already begun to decline.[15] Its total working age population is poised to start decreasing in 2015. This trend is exacerbated by traditions of early retirement, e.g. in clerical jobs, particularly for female workers. Already, the proportion of older, sicker, and less educated workers is starting to rise.

These trends threaten the core of China’s current labor-intensive growth model, which is built on manufacturing conducted by large numbers of extremely low-salaried workers. While China’s technological capabilities have improved in many respects, it has not yet succeeded in moving far up the added value chain. For the first time since China’s economic boom started in the 1980s, large numbers of factories in the industrial heartland of Guangdong’s Pearl River Delta have closed and others have struggled to find workers even after raising wages significantly.

China’s one child policy, for all its loopholes and unevenness in application—combined with the financial and social opportunities and pressures accompanying some of the world’s most rapid urbanization—is yielding a “4-2-1 problem”—an increasing population of “kinless families” of single children of single children with no aunts, uncles, or cousins, only ancestors and a child or two of their own at most. By one estimate, “by 2020 roughly 42% of urban China’s prospective parents [may] be only children… by 2030 only children would account for the clear majority (58%) of adults in this group.”[16]

“By any yardstick one cares to select,” explains Eberstadt, “Chinese society overall will be graying at a tremendously rapid, and indeed almost historically unprecedented, pace over the next generation.”[17] By 2040, “China’s projected proportion of senior citizens 65 years and older would be far higher than that of the United States or Europe today—indeed, possibly higher than any level yet recorded for a national population.”[18] “In urban China, fertility today is extraordinarily low, with TFRs [Total Fertility Rates] averaging perhaps 1.2 and TFRs of barely 1.0 in the largest metropolitan areas such as Beijing, Shanghai, and Tianjin.”[19] Meanwhile, albeit in part because of an exodus of young workers to cities, China’s countryside—envisioned to be the location of China’s next wave of low-cost growth to reduce inequality—is graying even more rapidly than its cities.

With sole responsibility for the care of four parents, couples in this position may increasingly look to the government for assistance. However morally valuable the pension and health care programs that emerge from this, they will take significant effort to establish as China lacks them almost completely now, and will detract from economic growth and defense spending.

A further consequence of the one child policy is a growing “surplus” of males that is already among the highest in the world. The current official sex ratio for 1-4 year old children is 123 (vice the biological norm of 105), and sex-selective abortion continues unabated. This may increase the number of men in their late thirties who have never been married from 5% to 25% by 2040—a trend of potentially significant social consequences, particularly in a country where universal marriage remains the norm.[20] In certain impoverished rural areas, it is already becoming extremely difficult for men to marry, which is fueling sham marriages and human trafficking and could ultimately result in unrest, as large pools of unmarried men in a society often spell trouble.[21]

Structural Issues

Chronic Health Problems and Pollution. China faces growing internal challenges from regional income disparities and rising incidences of chronic health problems such as cancer and diabetes that will require very significant financial resources to address while still trying to maintain economic growth. These health challenges are exacerbated by the rapid aging of Chinese society described above. World Bank studies have estimated that air pollution caused damages that could be worth as much as 4.6% of China’s GDP in 1995 and nearly 4% in 2003, while a recent MIT study estimates that the damages may have been as much as 6% of GDP in 2005.[22] Water pollution is also a serious problem. The bottom line is pollution has likely kept China from producing at its full economic potential.

Rising incidences of cancers that may be related to pollution (such as the more than 450 “cancer villages” clustered in heavily polluted areas) and lifestyle and diet-driven ailments like diabetescreate a major political dilemma: absorb the costs and treat the patients, or allow the many patients who cannot afford expensive long-term treatment to die and risk further alienating many segments of China’s population, which can communicate increasingly well through microblogs, mobile phones, and other means despite official Internet censorship and other controls.

Despite these problems, however, China will be less willing than many other countries “to sacrifice output growth to avoid environmental harm.”[23] Most economies, including those of the U.S., Europe, and the Asian Tigers, have developed using highly polluting industries first, and then improved environmental conditions when resulting growth in standards of living generated new societal priorities. Beijing’s desire to reduce the disparity between China’s First World coastal cities and Third World countryside make it unlikely that the ‘grow first’ mentality can be changed soon.

Water constraints. “Thousands have lived without love; not one without water,” as Anglo-American poet W. H. Auden reminds us. Access to potable water represents one of the greatest potential sources of conflict in the 21st century. In China, fresh water represents perhaps the most pressing resource shortage, since it directly impacts local and global food security. Local experts such as Zheng Chunmiao, director of Peking University’s Water Research Center, say that China needs to begin reducing water consumption or it will face dire consequences within 30 years.[24] Given that agriculture accounts for more than 60% of China’s water consumption, a logical step would be to either increase water prices or enact administrative restriction on use. Both options would likely reduce domestic grain production and force the country to import more staple grains, which in turn could increase global grain prices and trigger instability in the developing world akin to the food riots that occurred during 2008.

Economic Issues

Debt-fuelled growth. Chinese economic growth has relied heavily in recent years on fixed asset investment in roads, rails, bridges, and airports, among other things. To finance these projects, many local governments took out bank loans, creating a local government debt burden that China’s National Audit Office estimates to be worth US$1.65 trillion, or roughly 27% of China’s 2010 GDP. The People’s Bank of China has estimated that the real figure could be closer to US$2.1 trillion, according to Minxin Pei.

Pei’s work points out that many of the local infrastructure projects are highly leveraged, meaning that the borrowers are likely to face substantial debt service costs. This will be a major problem if Pei’s analysis holds true, as he cites a local banking regulator as claiming that only 1/3 of the investment projects will produce cash flows large enough to cover their debt service burden.[25]

Beijing’s decision to increase interest rates as it fights inflation may help slow the pace of debt accumulation in China, but with the existing burden, if China’s growth slows—driven by the factors we discuss, or possibly others—non-performing loans could quickly become a major problem. In turn, the diversion of state financial assets to resolve bad debt problems would exact opportunity costs by keeping the money from being used for more productive purposes.

Sustainability and future challenges of rapid infrastructure buildout

China’s rapid buildout of roads, rails, ports, airports and other physical infrastructure in the past several decades has been amazing in terms of its speed and scale. However, events such as the tragic July 2011 high speed train crash near Wenzhou raise three very important questions:

1. What is the quality of this shiny and quickly-built new infrastructure?

2. Are there large hidden future costs of having to demolish and rebuild infrastructure that was built for speed and sparkle rather than quality and safety?

3. Will China be able to bear the longer-term costs of maintaining it in good, safe, working order?

With proper supervision, Chinese construction firms can build world-class infrastructure at competitive prices. However, in practice, the potent cocktail of politically-induced time pressure, corruption, and a safety culture that remains lax for a country with China’s aspirations have combined to yield an infrastructure base that far too often literally kills.

Examples in recent years include the increased death toll in the 2008 Sichuan earthquake due to shoddy buildings constructed by corrupt contractors who cut corners to pocket the difference between the cost of high and low quality materials; and the July 2011 Wenzhou train crash, which killed 40 people when lightning allegedly stopped a bullet train that was then rear ended by another. In contrast, Japan, which has operated its bullet train system for decades through major earthquakes and other events, has only experienced one fatal accident (when a passenger was caught in a door).[26] A key difference is that Japan spent the time and resources required, not only to build in both physical safety features (“hardware”) but also to train operators (“software”) to a very high standard.

Certain types of infrastructure are inherently dangerous and even countries with very strong safety cultures can experience major problems, as Japan has with its Fukushima nuclear power plants in the wake of the powerful March 2011 Tōhoku earthquake and tsunami. However, China’s ‘get it done as fast as possible’ infrastructure build-out mentality raises concerns as the country looks to build complex and potentially dangerous projects in coming years, including more than 26 nuclear reactors that are currently under construction and an additional 8,000 km to its high speed rail network if the full network that was planned before the Wenzhou crash is completed.[27]

The second concern is that additional Wenzhou-type accidents could generate pressure to re-do substantial portions of China’s infrastructure base, particularly railways. Such rebuilds would be very costly, would probably double the cost of originally building the project, and would also incur the opportunity cost of removing transport routes from service for a considerable time.

A third concern, and one that has largely gone unmentioned amidst the focus on building the infrastructure, is how much will it cost to maintain it? This is an issue that is not likely to manifest itself immediately, but could become an increasingly important issue in the 10-15 year timeframe, particularly if a substantial portion of the country’s infrastructure turns out to be low quality.

Poorly built infrastructure can kill and maim immediately, as China’s train crash shows, but even well built infrastructure can become unsafe as it ages if it is not cared for properly. Take, for example, the 4-year old I-35W bridge in Minneapolis, Minnesota, which collapsed on 1 August 2007, killing 13 people and injuring 145.[28] Rising wages and materials costs are likely to magnify the infrastructure maintenance burden China will face in coming years.

Rising production costs and the need to move up the economic value-added ladder. The majority of Chinese exporters serve as global subcontractors, effectively leaving a large portion of a product’s value added on the table. This is particularly true in the electronics sector, where Foxconn, perhaps the world’s premier electronics contract manufacturer, typically makes gross margins of 8-10%; while Apple, which develops and sells the iPhones and other gadgets, generally enjoys gross margins that hover between 35% and 40%. More broadly, Chinese export-focused industrial firms have generally made profit margins in the 3-5% range during the last seven years, according to JP Morgan.

For the Chinese government, the concept of moving up the value chain is a question of pride and profit. Foxconn is a powerful company, but likely does not represent the sort of national champion that Beijing wants to build its long-term economic development strategy around since an approach based on cost-competitiveness as opposed to quality, innovation, and branding leaves major parts of the economy highly resource-intensive relative to their output value and also exposes China to outsourcing risks of its own.

China also needs better intellectual property protection to move up the value added chain.[29] There is a rising culture of using the court system to defend intellectual property and business interests. A potentially thorny issue for Beijing is that as intellectual property and business assets receive increasing legal protection, Chinese citizens may ask why the country has space in the court system for safeguarding economic assets, but cannot extend the same level of legal protection to private property and personal liberties.

Continued repression of alternative viewpoints and covering up of information, like that seen in the wake of the tragic July 2011 Wenzhou bullet train crash, is not a promising sign in a country that needs a degree of openness for ideas and innovation to arise.

Improving quality control and branding. The two go hand in hand, because melamine-tainted milk and buildings that collapse spontaneously in Shanghai do not inspire the consumer confidence necessary to build a strong global brand and reap the economic rewards. Chinese companies are often highly innovative and efficient, but with the exceptions of Haier and several other firms, few have created global brands. A greater global brand presence would be a significant boost to China’s economic growth potential.

China’s domestic heavy equipment sector clearly shows how powerful branding is, with Caterpillar, John Deere, and other foreign vendors able to charge much higher prices for comparable equipment than can most domestic manufacturers. Brand building within China is likely to depend heavily on how well the business law and intellectual property (IP) regimes can protect innovations from the rampant and rapid copying that currently makes it difficult for innovative Chinese firms to recoup their product development costs and fully enjoy the economic value of their product and re-invest in new developments. For example, in terms of what a company can do, US$1 billion in revenue at 5% margins is very different from US$1 billion at 20% margins, which allows a company to invest more in its R&D and generally sets up a dynamic that can foster greater innovation and economic dynamism moving forward.

Security Issues

Internal security. China experienced as many as 180,000 “mass incidents” in 2010 and the government spent more last year on domestic security than it did in its official military budget.[30] The decision of Chongqing, China’s most populous metropolitan area, to install at least 200,000 additional security cameras in the next three years as part of its “Peaceful Chongqing” initiative, atop the 300,000 it already has in place, sheds light on the sense of insecurity Chinese officialdom currently feels. Installing the project infrastructure is expected to cost at least 5 billion RMB (US$774 million), according to the Chongqing Daily.

The camera system will be paired with a range of analytical software and authorities also aim to link a range of diverse camera feeds to allow more effective monitoring. The upfront investment in such projects is huge and can run into the billions of dollars for a large city. However, over the longer-term, greater use of automation helps reduce China’s traditional reliance on a very people-intensive approach to security and surveillance. Large video surveillance networks backed by analytical software and server-based video archiving may offer a cheaper (and more effective) tool for monitoring dissent. In essence, cameras are simply replaced when they get old and do not sleep on the job, or demand pay raises, benefits, and pensions.

Also, once the basic network and analytical architecture are built, additional cameras can be added at a relatively low unit cost and likely for much less over time than the US$2,500-to-5,000 or more per year that it would likely cost to employ each human intelligence agent. At the same time, other Chinese approaches to security, bureaucracy, and commerce remain extremely people-intensive, and it is unclear how sustainable these approaches may be as wages and personal expectations rise in coming years.

External Security. China’s military modernization likewise depends heavily on the state of the economy. Strong increases in spending will be essential for China to secure the role it desires as East Asia’s most powerful non-U.S. military force. To truly displace the U.S. from the region and become a more globally-capable power, even larger spending increases would be needed. In addition, the country’s robust economic growth has also injected China’s leaders with a new confidence and assertiveness, particularly since the 2008 financial crisis, while also allowing the People’s Liberation Army (PLA) to rapidly boost its military spending and modernize its arsenal. In short, China’s rise as a key global economic and security player depends critically on its economy and the trajectory of its power moving forward is likely to hinge heavily on the country’s economic growth path.

Demography too is likely to influence the PLA’s future doctrine and capabilities. Many trainees from urban areas—the vast majority of which are single children—are said to be physically unfit and psychologically fragile. But part of this trend is spreading even to rural areas, which traditionally supply the bulk of PLA recruits. By some estimates, 80% of enlistees in PLA operational units are single children.[31] The consequences of the PLA becoming a “Single Child Military” should not be underestimated—it may have significant implications for families’ willingness to part with sons for conscription periods that could interfere significantly with rural agriculture, and could even increase casualty aversion to unprecedented levels that might not be compatible with some elements of PLA doctrine.

In the longer term, a variety of factors may limit PLA budget growth, at least to some extent. Various structural factors including higher health care and pension costs and rapidly rising wages that will erode the Chinese defense industry’s labor cost advantages could greatly restrict China’s ability to sustain rapid military spending growth, regardless of its leaders’ intentions. Personnel, equipment, and operational costs are all rising for the PLA, and there will be a limit to what can be afforded in the future. In coming years, China’s leaders are likely to face wrenching tradeoffs not seen since the post-1978 reforms as China’s population ages, develops increased lifestyle expectations, questions the wisdom of tolerating a growth-at-all-costs mentality, and yet is likely to remain strongly nationalistic.

Additionally, even if the PLA budget continues to grow steadily, factors internal to the PLA could compound the national structural factors discussed above and limit its overall force structure and capabilities.[32] For example, increased personnel costs are already consuming an increasing percentage of its overall budget as the PLA works to improve the living standards of its soldiers and their families. PLA officers, for example, now bring home roughly US$845 (5,400 RMB) per month on average, the highest in PRC history, a very competitive wage compared to Chinese state owned enterprise employees’ average monthly earnings of closer to US$626 (4,000 RMB).[33]

Even at a lower level of defense spending, China could still increase its power and influence substantially in East Asia and even challenge U.S. and allied interests there substantially, but the nature of the challenge could be very different depending on how Beijing chose to allocate its resources between national defense and pressing domestic priorities such as education and healthcare.

China’s military is developing in concentric layers of progressively lower emphasis and capability, with mainland China’s domestic security as the highest priority and most intensely emphasized area of development; the Near Seas (Yellow, East China, and South China Seas) second; the Indian Ocean third, and other “far seas” fourth. Beijing’s current focus developing conventionally-powered submarines, missiles, sea mines and other platforms and weapons systems that focus on anti-access/area denial (A2/AD) missions in the Near Seas by targeting specific physics-based limitations in foreign systems is an extremely efficient and cost-effective approach.

Developing high-level combat operations capabilities far beyond the Near Seas would negate many of these efficiencies for Beijing. It would entail a loss of strategic focus, new operational liabilities, and perhaps more complex and costly strategic relations. It would require both massive platform and weapons systems investments and operational and personnel costs; as well as mastering, and becoming more reliant on, the developments in air- and space-based platforms and C4ISR needed to support significant military operations far from the many facilities on or near China’s shores.

Ironically, these systems might become more vulnerable to the very sort of electronic, computer network, and kinetic attacks and other asymmetric measures that Beijing is pursuing to offset U.S. military power. This could place PLA forces at the costly end of some of the same asymmetric arms races from which they have thus far benefitted.

Implications

China’s rise could be slowed, complicated, or even threatened in critical aspects with derailment by a wide range of other issues, including water and resources shortages, environmental devastation, ethnic and religious discord, income and urban-rural inequality, enduring corruption, social unrest, and political transition.[34] “Any of these problems might be soluble in isolation,” assesses the NIC, “but the country could be hit by a ‘perfect storm’ if many of them demand attention at the same time.”[35]

Such setbacks could be particularly dangerous for the Party given popular expectations of rising living standards and foreign treatment of China being based in part on its perceived future potential. Substantial economic and even political reforms—at least increased rule of law, political pluralism, and freedom of expression—may be needed to address the needs of Chinese society in the future.

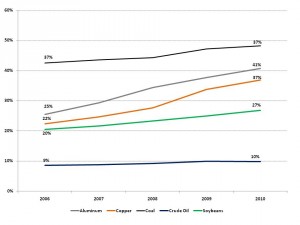

Disruptions to China’s growth would hit mineral exporting countries particularly hard, as demand for iron ore, copper, oil, soybeans, machinery, and other good and resources has come to drive much of the economic growth enjoyed by Brazil, Chile, Russia, Australia, Indonesia, and other resource producers. China accounts for a large percentage of global demand of many key commodities, including crude oil, copper, aluminum, coal, and soybeans (Exhibit 3). In many cases, China’s share of demand for the commodity has increased substantially. For example, China consumed an estimated 22% of global copper demand in 2006 and 37% in 2010 and 20% of global soybean demand in 2006 and 27% in 2010.

Exhibit 3: China share of global demand for key commodities

% of total global consumption, by year

Source: International Copper Study Group, Rusal, USDA, BGRIMM, China SignPost™

In recent years, China has accounted for the lion’s share of global demand growth for a range of very important commodities. In some instances this reflects the shift of energy and commodity-intensive industries to China—as is the case for aluminum, lead, and zinc, for example. In other cases such as soybeans, it reflects the reality that China’s domestic demand for a given natural resource or agricultural product is growing explosively as consumption of meat and other goods rises.

On the microeconomic level, companies—particularly in the natural resources sector—are making multibillion dollar investments predicated on assumptions of strong Chinese growth for decades to come. Lower economic growth rates in China would still produce substantial annual increases in mineral demand due to the country’s massive economy, but a mining firm that uses 7-8% Chinese growth as a base case for developing a project could face difficulties if the longer-term growth rate turns out to be ‘only’ 4% per year.

The same construction and commodity demand boom has also made China a key focal point for the investment community, which is arguably coming to care as much or more about Beijing’s economic policy measures as it does about the actions of the U.S. Federal Reserve Bank. Viewed in this light, anyone who owns stocks or receives a pension from funds with investments in Chinese firms or companies who are deriving a substantial portion of their profits and growth from the China market should pay attention to this.

On the strategic front, slower growth and rising costs from internal challenges could crimp China’s ability to spend on military modernization. This could substantially curtail the country’s ability to become a major naval and air power outside of its immediate neighborhood.

As for the S-Curve dynamic and what can be done about it, Beijing’s leaders will surely state that they retain control. As for the United States’s own S-Curve dynamic, its far-less-externally-unified leadership will likely continue to put faith in the American system to perpetuate prosperity and preeminence. Such a ‘strategy’ of ‘hope,’ is hardly more realistic than one of central planning, however.

To be sure, the U.S. still enjoys abundant resources, cutting-edge universities and research institutions, an innovative capitalist economy, the world’s largest and most advanced military, a diverse and adaptable democratic society, a robust and reasonably efficient legal and regulatory system, attractive cultural “soft power,” and the most favorable demographic and immigration profile in the OECD, and allies, friends, and partners with which to cooperate.

China itself enjoys the advantages of relatively high government policymaking coherence and a large population with an enterprising spirit that values education and has a tremendous work ethic.

Having studied the history of great powers’ rise and fall closely, Paul Kennedy approvingly cites 19th century German statesman Otto von Bismarck as stating that such nations are condemned to “‘steer with more or less skill or experience’” in a “‘stream of Time’” that they can “‘neither create nor direct’.”[36] Time will tell the extent to which Beijing and Washington are chained to their S-Curve trajectories. Regardless of their respective courses, the impact will shake the world.

About Us

China Signpost™ 洞察中国–“Clear, high-impact China analysis.”©

China SignPost™ aims to provide high-quality China analysis and policy recommendations in a concise, accessible form for people whose lives are being affected profoundly by China’s political, economic, and security development. We believe that by presenting practical, apolitical China insights we can help citizens around the world form holistic views that are based on facts, rather than political rhetoric driven by vested interests. We aim to foster better understanding of key internal developments in China, its use of natural resources, its trade policies, and its military and security issues.

China SignPost™ 洞察中国 founders Dr. Andrew Erickson and Mr. Gabe Collins have more than a decade of combined government, academic, and private sector experience in Mandarin Chinese language-based research and analysis of China. Dr. Erickson is an Associate Professor at the U.S. Naval War College’s China Maritime Studies Institute (CMSI) and an Associate in Research at Harvard’s John King Fairbank Center for Chinese Studies. Mr. Collins is a commodity and security specialist focused on China and Russia.

The authors have published widely on maritime, energy, and security issues relevant to China. An archive of their work is available at www.chinasignpost.com.

[1] Michael Pettis, “Get Used to Slower Chinese Growth,” The Wall Street Journal, 11 August 2011, http://www.carnegieendowment.org/2011/08/11/get-used-to-slower-chinese-growth/4li5.

[2] Office of the Director of National Intelligence, Global Trends 2025: A Transformed World(Washington, DC: National Intelligence Council, November 2008), vi-vii,http://www.dni.gov/nic/PDF_2025/2025_Global_Trends_Final_Report.pdf.

[3] Mark Thompson, “Veteran U.S. Diplomat: We Are Becoming the USSR,” Battleland Blog, 17 May 2011, http://battleland.blogs.time.com/2011/05/17/veteran-u-s-diplomat-we-are-becoming-the-ussr/.

[4] Paul Kennedy, The Rise and Fall of the Great Powers: Economic Change and Military Conflict from 1500 to 2000 (New York: Vintage Books, 1989), xxiii.

[5] “After Historic Downgrade, U.S. Must Address its Chronic Debt Problems,” Xinhua, 6 August 2011, http://news.xinhuanet.com/english2010/indepth/2011-08/06/c_131032986.htm.

[6] “Convergence, Catch-Up and Overtaking: How the Balance of World Economic Power is Shifting,” PricewaterhouseCoopers LLP, January 2010,http://www.ukmediacentre.pwc.com/imagelibrary/downloadMedia.ashx?MediaDetailsID=1626; and Jim O’Neill, “China Shows the World How to Get Through a Crisis,” Financial Times, 23 April 2009, http://www.ft.com/intl/cms/s/0/dd9b5a1e-2f9f-11de-a8f6-00144feabdc0.html#axzz1BfEyxaV7.

[7] “Dreaming with BRICs: The Path to 2050,” Global Economics Paper No. 99, 1 October 2003,http://www2.goldmansachs.com/ideas/brics/book/99-dreaming.pdf.

[8] Michael Pettis, “Get Used to Slower Chinese Growth,” The Wall Street Journal, 11 August 2011, http://www.carnegieendowment.org/2011/08/11/get-used-to-slower-chinese-growth/4li5.

[9] “Upside” risks are possible trends that could drive further growth—for example, urbanization and higher domestic consumption. “Downside” risks are possible trends that could constrain growth and development—for example, chronic health problems and high local government debts.

[10] Robert Gilpin, War and Change in World Politics (Cambridge, UK: Cambridge University Press, 1983), 78, 107.

[11] See, for example, Paul Nunes and Tim Breene, “Jumping the S-Curve: How to Beat the Growth Cycle, Get on Top, and Stay There,” Accenture High Performance Institute, 16 November 2010,http://www.accenture.com/SiteCollectionDocuments/PDF/Accenture_Jumping_the_S_Curve.pdf.

[12] Jason Dean and Jeremy Page, “Trouble on the China Express,” The Wall Street Journal, 30 July 2011,http://online.wsj.com/article/SB10001424053111904800304576474373989319028.html.

[13]“China sets same growth targets for GDP and resident income to rebalance development,” Xinhua, 5 March 2011, http://news.xinhuanet.com/english2010/china/2011-03/05/c_13763059.htm

[14] Nicholas Eberstadt, “Asia-Pacific Demographics in 2010-2040: Implications for Strategic Balance,” in Ashley J. Tellis, Andrew Marble, and Travis Tanner, eds., Asia’s Rising Power and America’s Continued Purpose (Seattle, WA: National Bureau of Asian Research, 2010), 243.

[15] Ibid., 262.

[16] Ibid., 250.

[17] Ibid., 248.

[18] Ibid., 246.

[19] Ibid., 247.

[20] Ibid., 249.

[21] Andrea Den Boer and Valerie M. Hudson, “A Surplus of Men, A Deficit of Peace: Security and Sex Ratios in Asia’s Largest States,” International Security, 6.4 (Spring 2002), 5-39,http://belfercenter.ksg.harvard.edu/publication/331/surplus_of_men_a_deficit_of_peace.html.

[22] Kira Matus, Kyung-Min Nam, Noelle E. Selin, Lok N. Lamsal, John M. Reilly and Sergey Paltsev, “Health Damages from Air Pollution in China,” MIT Joint Program on the Science and Policy of Global Change, Report No. 196, March 2011,http://globalchange.mit.edu/files/document/MITJPSPGC_Rpt196.pdf.

[23] Peter A. Petri, “Asia and the World Economy in 2030: Growth, Integration, and Governance,” in Ashley J. Tellis, Andrew Marble, and Travis Tanner, eds., Asia’s Rising Power and America’s Continued Purpose (Seattle, WA: National Bureau of Asian Research, 2010), 61.

[24] Jonathan Watts, “China Told to Reduce Food Production or Face ‘Dire’ Water Levels,” The Guardian, 28 June 2011.

[25] Minxin Pei, “China’s Ticking Debt Bomb,” 5 July 2011, The Diplomat, http://the-diplomat.com/2011/07/05/china%E2%80%99s-ticking-debt-bomb/.

[26] “Dissent in China: Of Development and Dictators,” The Economist, 5 August 2011,http://www.economist.com/node/21525419.

[27] World Nuclear Association, http://www.world-nuclear.org/; see also Keith Bradsher, “High Speed Rail Poised to Alter China,” The New York Times, 22 June 2011,http://www.nytimes.com/2011/06/23/business/global/23rail.html?pagewanted=all.

[28] Amy Forliti, “URS Says it Didn’t Know I-35W bridge Would Fall,” Minnesota Public Radio, 8 July 2010, http://minnesota.publicradio.org/display/web/2010/07/08/35w-bridge-contractor/.

[29] Richard P. Suttmeir and Xiangkui Yao, “China’s IP Transition: Rethinking Intellectual Property Rights in a Rising China,” National Bureau of Asian Research, Special Report 29 (July 2011), http://www.nbr.org/publications/specialreport/pdf/Free/SR_29_ChinaStandards.pdf.

[30] Michael Forsythe, “China Cracks Down in Wake of Riots, Bombings,” Bloomberg, 13 June 2011, http://www.bloomberg.com/news/2011-06-13/china-cracks-down-in-wake-of-riots-bombings.html.

[31]“More than 80% of PLA soldiers are single children,” (解放军作战部队独生子女已超八成), 15 August 2011, Beijing Wanbao,http://military.china.com/news/568/20110815/16706353.html.

[32] Leading indicators of changes in the parameters of China’s defense spending include the Chinese economy’s growth, the central government’s ability to collect revenues and propensity to spend them on non-military programs (e.g., a future national pension system and other welfare benefits for China’s increasingly socially stratified and rapidly aging population), personnel salaries (e.g., competitive pay to attract a dwindling population of draft-eligible individuals amid increasingly attractive private sector alternatives), national spending on research and development, and weapons imports.

[33] “Survey: PLA Officers Monthly Income Hits 5,400 Yuan,” People’s Daily, 19 May 2011,http://english.peopledaily.com.cn/90001/90776/90882/7385774.html.

[34] For further discussion, see “Changing, Challenging China,” Harvard Magazine (March-April 2010): 25-33, 73.

[35] Office of the Director of National Intelligence, Global Trends 2025: A Transformed World(Washington, DC: National Intelligence Council, November 2008), 30,http://www.dni.gov/nic/PDF_2025/2025_Global_Trends_Final_Report.pdf.

[36] Paul Kennedy, The Rise and Fall of the Great Powers, 540.