Beijing Offers Most Comprehensive Statement to Date on New PLA Navy Logistical Facilities in Djibouti

Thanks to Nizar Manek for bringing this to my attention!

Foreign Ministry Spokesperson Hong Lei’s Regular Press Conference on January 21, 2016

Q: President Ismail Omar Guelleh of Djibouti announced on January 20 that a series of agreements have been signed with the Chinese side to set up a free trade zone, expand Djibouti’s role for transshipment of goods in trade between China and the world, and let Chinese banks operate in Djibouti. Why does China attach so much attention to the country?

A: Friendly relations between China and Djibouti have been forging ahead over recent years, as evidenced by constantly increased political mutual trust, flourishing cooperation in economy and trade and vibrant cultural exchanges. During his attendance at the FOCAC Summit in Johannesburg, President Xi Jinping met with President Guelleh, reaffirming their commitment to enhancing the bilateral relationship, safeguarding regional peace and stability and promoting common development. China and African countries are making efforts to implement the consensus reached at the Johannesburg Summit, in a bid to drive development in Africa. Agreements signed by China and Djibouti are part of the efforts.

Q: Is the escort mission in the Gulf of Aden the only purpose of China’s setting up of military facilities in Djibouti?

A: Vessels have been sent by China to the Gulf of Aden and the waters off the Somali coast for escort missions in recent years. In fulfilling escort missions, we encountered real difficulties in replenishing soldiers and resupplying fuel and food, and found it really necessary to have nearby and efficient logistical support. China and Djibouti consulted with each other and reached consensus on building logistical facilities in Djibouti, which will enable the Chinese troops to better fulfill escort missions and make new contributions to regional peace and stability. The nature of relevant facilities is clear, which is to provide logistical support to Chinese fleets performing escort duties in the Gulf of Aden and the waters off the Somali coast.

U.S. AFRICOM Commander GEN David Rodriguez, USA Confirms: China Signed 10-Year Contract for Military Logistics Hub in Djibouti—Beijing’s 1st-Ever Overseas “Base”/Facility

Djibouti… it’s finally official!

U.S. African Command (AFRICOM) Commander General David Rodriguez, U.S. Army, has just confirmed that China has signed a 10-year contract for a military logistics hub in Djibouti. This makes the African desert nation home to Beijing’s first-ever overseas military facility, however modest, or “base” in common parlance. “They are going to build a base in Djibouti, so that will be their first military location in Africa,” Rodriguez stated. Located by the Bab-el-Mandeb, a chokepoint in the Red Sea between the Indian Ocean and Mediterranean Sea, New Jersey-sized Djibouti enjoys a location of prime geostrategic importance. Djibouti has capitalized on its location to host several foreign bases; now China is joining the United States, France, and Japan in opening a military facility there.

This is a significant development indeed. It will be interesting to see how China’s official spokespeople and state media portray its entry into the overseas facility club, now that the U.S. has confirmed it officially. Most laypeople will term China’s facility a “base,” a term that Beijing will almost certainly avoid. The following article from The Hill offers the latest news, while China SignPost report #91 (appended below) offers detailed background.

Now it’s time to further examine recent and ongoing activities by Chinese state-owned corporations in Djibouti, particularly around Doraleh. According to my research with former Naval War College China Maritime Studies Institute (CMSI) intern Kevin Bond (as published in the USNI News article excerpts appended below China Signpostreport #91:

- China Communications Construction Company (CCCC) Tianjin has constructed a salt pier in Djibouti.

- China Merchants Holdings (International) (CMHI) holds a 23.5% stake in Port de Djibouti S.A., which includes two-thirds of the port’s Doraleh Container Terminal.

- Construction of the Damerjog livestock port and the multipurpose Doraleh port, with both projects launching in 2013, are being funded by China Merchants Group.

- China State Construction and Engineering Company (CSCEC) won the bid for the engineering, procurement, and construction (EPC) project of Phase I of the Doraleh Wharf in August of 2014, which includes the construction of a 1,200m long frontage for five multi-purpose deep water berths, a 175m long service berth, and related supporting facilities, all in Djibouti.

As documented in my 200-page book with Harvard Ph.D. student Austin Strange, China’s People’s Liberation Army Navy (PLAN) has long called on Djibouti. Here’s a partial (likely incomplete) list of PLAN port calls on Djibouti (and their stated purpose) in conjunction with its twenty-and-counting anti-piracy task forces to the Gulf of Aden since December 26, 2008:

- January 24, 2010, Replenish/Overhaul

- May 3, 2010, Replenish/Overhaul

- September 13, 2010, Replenish/Overhaul

- September 22, 2010, Replenish/Overhaul

- December 24, 2010, Replenish/Overhaul

- February 21, 2011 Replenish/Overhaul

- October 5, 2011, Replenish/Overhaul

- March 24-29, 2012, Replenish/Overhaul

- May 14, 2012, Replenish/Overhaul

- August 13-18, 2012, Replenish/Overhaul

- December 1-6, 2012 Replenish/Overhaul

- June 6-8, 2013, Replenish/Overhaul

- July 28, 2013, Replenish/Overhaul

- October 7-9, 2013, Replenish/Overhaul

- February 22-26, 2014, Replenish/Overhaul

- April 1-5, 2014, Replenish/Overhaul and Friendly Visit

- June 30- July 4, 2014, Replenish/Overhaul

- September 8-12, 2014, Replenish/Overhaul

- November 3-7, 2014, Replenish/Overhaul

- January 25-30, 2015, Replenish/Overhaul

Scroll down to the very bottom for links to additional analysis.

Kristina Wong, “China’s Military Makes Move into Africa,” The Hill, 24 November 2015.

China is establishing its first military base in Africa, according to a top U.S. general, providing yet another sign of its growing reach beyond the Asia-Pacific.

“They are going to build a base in Djibouti, so that will be their first military location in Africa,” U.S. Army Gen. David Rodriguez, the commander of U.S. Africa Command, recently told defense reporters.

There has been speculation for years that China might establish a base in Djibouti. Rodriguez said China has signed a 10-year contract with the African nation.

The base, he said, would serve as a logistics hub for China to be able to “extend their reach.”

Setting up a military base in Africa makes perfect sense given China’s vast economic presence in the region, said J. Peter Pham, director of the Africa Center at the Atlantic Council. The base would be cheaper than China’s current, temporary arrangements that allow for docking ships at Djibouti ports to conduct naval patrols, he said.

The base also gives China an airfield that could significantly improve its intelligence gathering capabilities over the Arabian Peninsula, Egypt, Eastern Libya and well into Central Africa.

… the United States, …has its own military base in Djibouti, at Camp Lemonnier, from which it conducts intelligence, counter-piracy and counterterrorism operations. …

China has recently signaled its desire to extend its military presence to more parts of the globe.

In a May white paper, China said its army would “adapt itself to tasks in different regions, develop the capacity of its combat forces for different purposes, and construct a combat force structure for joint operations.”

China said its navy would “gradually shift its focus from ‘[near seas] defense’ to the combination of ‘[far seas] defense’ [and] ‘[open ocean] protection.’” …

China SignPost™ (洞察中国) #91: “Djibouti Likely to Become China’s First Indian Ocean Outpost”

Gabriel B. Collins and Andrew S. Erickson, “Djibouti Likely to Become China’s First Indian Ocean Outpost,” China SignPost™ (洞察中国) 91 (11 July 2015).

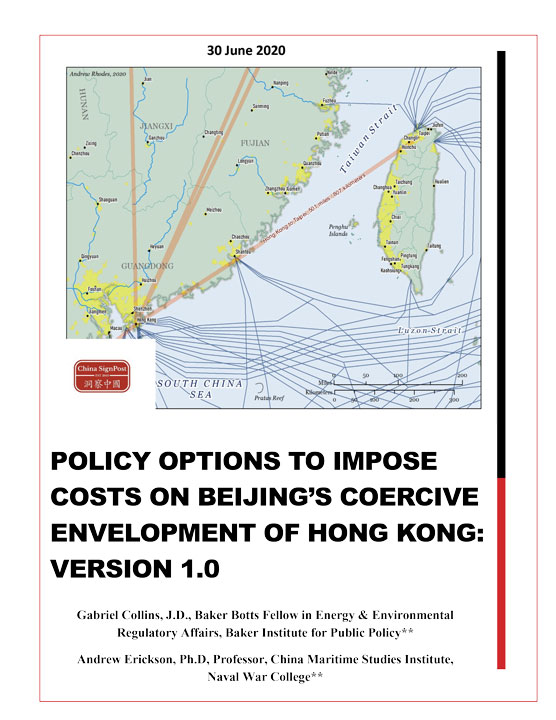

China is now laying the diplomatic and legal foundations for a long-term naval presence in Djibouti, with a range of recent media reports alleging that Beijing is negotiating for naval access in the country. The facilities would likely be located at Obock, on Djibouti’s northern coast (Exhibit 1). While China will not formally call the facilities a “base” anytime soon, it will likely function in a manner that brings it awfully close to being one in all but name.

Durable access to facilities in Djibouti that can be easily improved by Chinese construction firms would give China a formidable—and more permanent—maritime and potentially aerial springboard deep into the Northwestern Indian Ocean Region, as well as North, East, and Central Africa. The black circle in Exhibit 1 shows the territory lying within a 2,500 km radius of Djibouti—a conservative estimate of the rough distance a Shaanxi Y-8 class maritime patrol aircraft would be able to cover without aerial refueling.

Exhibit 1: Djibouti’s Strategic Position in the Indian Ocean Region

Source: GADM, Authors’ analysis

The idea of more enduring Chinese military presence in Djibouti has clearly advanced far beyond the realm of speculation, and is now approaching the stages of signing paper, moving assets, and potentially soon pouring concrete. Negotiations appear well underway. Even more definitive than Djibouti President Ismail Guelleh’s direct statements to Western media that his government has been negotiating with China to establish a Chinese facility is the excerpt below from the interview he granted to Saudi-owned newspaper Al-Hayahon 1 June 2015:

Q: You have a U.S. base, another French base, and a Japanese base. I think that a Chinese base will be opened soon. What if Iran proposed to you the opening of a base for it in Djibouti?… Have the military bases benefited Djibouti?

Guelleh: Yes, a great deal…. We will now sign an agreement with China. We are bound by strong ties with them [the Chinese].

Q: When will the Chinese base start working?

Guelleh: Perhaps we will sign the agreement officially after two weeks.

Q: And what if India requested a base for it[self]?

Guelleh: We have no intention of approving the opening of other bases. That is enough.

Djibouti has been a critical cog in the PLAN’s now 78-month long anti-piracy deployment off the Horn of Africa. Chinese naval vessels have reportedly visited the port more than 50 times since the mission began in December 2008. China cemented the diplomatic foundation for basing with a February 2014 meeting between President Guelleh and General Chang Wanquan, after which the two countries signed a defense and security pact.

Since then, the “strong ties” that Guelleh stresses have continued to develop, and furthered both sides’ interests. On 1 July 2015, the Information Agency of Djibouti reported proudly, Xi Jinping sent best wishes for the country’s National Day and praised the “development of China-Djibouti relations.” Beyond the two countries’ growing economic cooperation, which includes major Chinese infrastructure investment in Djibouti, the Red Sea nation is beginning to receive technological blandishments from Beijing. On 18 June 2014, the Djiboutian Air Force received aMA-60 transport aircraft. During Djibouti’s 27 June 2015 Independence Day parade, its armed forces displayed aNorinco WMA301 Assaulter tank destroyer.

To seal matters from the Chinese side, a strong domestic legal framework now sits atop the robust pre-existing diplomatic ties. China’s National People’s Congress in May 2015 laid the foundation for the military to claim that long-range overseas missions are a legally recognized operational mandate. Specifically, Clauses 28 and 30 of the new National Security Law (国家安全法) call for the protection of strategic energy supply channels, PRC citizens abroad, and other external interests.

The timing—and Beijing’s refusal to deny reports of a pending grant of basing access—are striking, particularly since the Somali pirate threat used to justify the deployment in the first place has dwindled over the past year. In a complete lack of a denial and indeed in theory a possible trial balloon of sorts, China Daily’s U.S. edition reported on 26 May, “Earlier this month, foreign media reported that China was building a permanent military base in the African country of Djibouti.” Evidence increasingly suggests Beijing intends to maintain a forward naval presence even if the risk of pirate attacks withers away. Having forward-deployed naval assets in a volatile and strategically vital region is simply too useful a capability to relinquish, as amply demonstrated by non-combatant evacuation operations from Libya in 2011 and Yemen in 2015 that each utilized warships dispatched from the PLAN’s Gulf of Aden task force.

Why Djibouti?

Chinese naval forces have increased their port call tempo across the Indian Ocean region in recent years, visiting Salalah, Oman and Djibouti more than 20 times apiece and visiting Pakistan, Myanmar, Burma, and Singapore multiple times as well. So, with such a plethora of options, why the focus on Djibouti? Below we outline several of the most important factors and offer a map illustrating Djibouti’s proximity to a number of regions that are of rising strategic interest to China.

First, geography. Djibouti offers unparalleled access to the Gulf of Aden and sits astride the strategic Bab al-Mandeb, a key global maritime energy transport artery that moved 3.8 million barrels per day of crude oil in 2013, according to the EIA, making it the world’s 4th busiest maritime energy chokepoint. It also offers an entry point into the Arabian Peninsula, the northwestern Indian Ocean, and a fair-sized chunk of Eastern and North-Central Africa. Furthermore, it is located only a few days’ sail from the Eastern Mediterranean.

Second, it’s the most secure and politically stable location near the largest number of key maritime and terrestrial interests China has in the region. We draw this somewhat semantically-heavy distinction because Singapore is obviously highly secure and stable, but it is also located too far away from the PLAN’s new forward operating areas in the Northwest Indian Ocean Region to be operationally useful in that regard. The primary contenders among current ports are Djibouti (i.e., at Obock), Aden, Salalah, Karachi, and Gwadar. Down the road, Bagamoyo (Tanzania) and Mombasa could enter the mix.

Yemen is a dangerous port area—especially with the current complex violence rending the country. But even before the contemporary cataclysm, Yemen had a bad history. The USS Cole attack in 2001 and the October 2002 attack on the supertanker Limburg almost certainly cooled Chinese naval planners’ willingness to risk using Aden as a resupply port. Pakistan also poses serious security challenges, particularly if China aspires to heavily utilize Gwadar, which sits near the core areas of a decades-long Balochi insurgency that has even claimed Chinese workers’ lives in the past 15 years. And with respect to Karachi, there is a crowded port to deal with, as well as a teeming and increasingly violent city that the PLAN likely does not want its sailors venturing into. Finally, Karachi is sufficiently far from major Indian Ocean transit routes as to impose extra sailing distance with its use.

Against this baseline, Djibouti would be an attractive basing location even if it were not as stable and secure as it in fact is. The tiny country has for more than a decade hosted thousands of French, U.S., and Japanese personnel who (especially the Americans) have been actively operating and even conducting kinetic strikes (drone missions) originating in Djibouti. Yet there have been no significant publicly disclosed security incidents. Democracy activists would certainly prefer to see President Guelleh loosen his grip on power, but the country’s population has been pacific for years and nothing appears poised to destabilize things in the foreseeable future. In the region, this is about the best political set up once can ask for. It is made all the better by the fact that the bases are largely self-contained, thus avoiding problems triggered by soldier misbehavior off base, but the bases inject enough money into the local economy that local officials (and probably a decent number of residents) are happy to host them. In addition, the military presence enhances Djibouti’s value as an East African entrepôt because pirates or dangerous neighbors (think Houthi rebels from Yemen) will shy away from operating near such a formidable concentration of military capability. Locals engaged in trade will appreciate this military umbrella.

Third, it offers the facilities and draft to accommodate any PLAN vessel in service now or in the foreseeable future. China’s largest forward-deploying warship at present, the Type 071 LPD, draws seven meters of water. Djibouti’s existing port can accommodate vessels drawing 18 meters. This is deep enough that it could even physically accommodate the entry of an aircraft carrier into the port. When China might in fact conduct such as mission remains unclear, but the physical capacity to accommodate this large a ship exists now at Djibouti’s existing port.

Fourth, it fits into the known Chinese strategic thought about how to go about creating an Indian Ocean supply and support network. PLAN scholar Jing Aimingprovides a useful framework through which to examine the PLAN’s thought on creating more permanent access points in the Indian Ocean Region.

Presumably bearing such fundamentals in mind, Jing offers a three-level typology of possible locations. The lowest-level entry points, in Tier 1, would allow refueling and supply, as well as commercial transactions. Leading candidates include Obock, Djibouti and Port Salalah, Oman. Jing also mentions Aden, Yemen—a location previously running some distance behind them in third place, but no longer in the running given Yemen’s civil war.

The next level up, Tier 2, would support fixed schedules of PLAN ship supply, air-based reconnaissance and platform replenishment, and crew rest. Jing deems Port Victoria, Seychelles the archetypal candidate in this regard. It clearly meets the political stability and support requirement. China has long pursued development finance projects in Seychelles. In 2011, Seychelles offered China an anti-piracy supply port arrangement. In March 2012, China announced plans to establish a presence in the Seychelles to support its anti-piracy mission. In May 2012, the two countries concluded an agreement (apparently still unused) allowing the PLAN to transfer detained pirates to Seychelles. In July 2013, the two sides signed various bilateral cooperation agreements. Less certain is Seychelles infrastructure potential and ability to support robust basing without becoming overwhelmed environmentally and socially. Such factors have reportedly limited the scope of U.S. access there to low-profile drone basing. But an informal Chinese “place” might be possible there, and preexisting U.S. entrée could make China appear less unilateral in pursuing it.

The highest level, Tier 3, begins to look a bit more like what the U.S. would at least term a “place” if not a full-fledged “base.” Jing envisions long-term, bilateral contractual agreements that enable more comprehensive supply, replenishment, crew rest, reorganization, possibly large-scale and even weaponry repair. Karachi, Pakistan, with some of the region’s stronger ship repair facilities, is the leading candidate for such a facility.

Jing’s analysis contemplates that within a decade, the PLAN could create modal supply network with a North/west Indian Ocean replenishment line incorporating ports in the Middle East as well as northern and eastern Africa and Central and southern lines relying on the Seychelles and Madagascar. Comprehensive access networks that effectively grid out the Indian Ocean region for the PLAN exist only in strategists’ minds at present. However, current events on the ground suggest such opinions should be viewed more seriously than would have been the case even five years ago. Analysts and policymakers should recognize that candidate ports’ positions in the Tiers ranking are not static. For instance, civil war in a country takes its ports off the list, but a change in Beijing’s strategic thinking, coupled with a receptive host government willing to allow Chinese investment in port facility upgrades could cause a port to rapidly jump to Tier 2 or even Tier 3 status within as little as 2-3 years.

China appears likely to fortify its presence in the IOR, but what form might this take in practice? Using a deductive approach, it is possible to imagine the possibilities. One possible answer lies in a network of “support points” with a hierarchical division of labor. Within a decade, Jing believes, China might develop a nodal network system in the IOR. He envisions two principal vectors: North/west Indian Ocean replenishment lines incorporating ports in the Middle East as well as northern and eastern Africa; and central and southern lines relying on the Seychelles and Madagascar. From a deductive perspective, it is useful to consider Jing’s vision and how it might play out in practice.

Criteria for effective locations include host nation political stability and support, favorable geography, adequate infrastructure, and port characteristics (primarily deep draft sufficient to accommodate most if not all naval ships).

To assess China’s IOR access prospects (and thereby test Jing’s vision), it is important to “follow the dragon tracks” and look inductively at what actions China has actually taken to date. Layering port characteristics and Chinese actions therein suggests that Obock, Djibouti and Port Salalah, Oman are the frontrunners to become “1st tier” support points by far. Both meet key criteria for basing desirability. They are located in resource-limited oases of stability in geopolitically complex regions. Their governments seek economic and political benefits by cultivating positive strategic relations with diverse outside powers. The ports offer the deepest draft of China’s regional options (18 m and 17.5 m respectively). Not surprisingly, then, they have received the most PLAN port calls (>20 each since 2009). But, as explained above, Djibouti appears to have pulled into the lead for more formally supporting the PLAN in the Indian Ocean Region. And it appears that it will do so from the port of Obock.

A Bit About Obock

Among the few candidate locations in Djibouti, Obock offers perhaps the best potential for the seclusion and expansion that China doubtless seeks, while simultaneously offering the host country the chance to develop and monetize a fallow backwater. At the current time, Obock is essentially a small fishing village, albeit one that with a few years of Chinese-led infrastructure investment could become an excellent military support facility. The authors have not yet been able to locate definitive data on Obock Port’s current draft limitations, but an analysis of overhead imagery suggests there is a deep natural channel entering the port from the south. Chinese engineering firms are clearly adept at rapidly dredging deep draft ports, as evidenced byChina Communications Construction Company’s creation of more than three square miles of reclaimed land in the South China Sea in recent months.

Obock also would give the Chinese military a relatively “exclusive” operating area. Pan Chunming, deputy director of an SSF political division has noted that “Once we coordinated with a foreign port to berth for three days. However, the port later only allowed us to stay for one day, because a Japanese ship was coming.” Pan was almost certainly referring to Djibouti and his statement highlights the need for proprietary access point real estate—especially when China would be sharing access to Djibouti with other militaries that, in the case of the U.S. or Japan, are potential adversaries. The area’s relative isolation and space to accommodate an airfield with large runways also would provide a number of other strategic advantages.

First, Djibouti is a useful muster and temporary refuge point for noncombatant evacuation operations (NEO) operations aimed at evacuating Chinese citizens from various conflict zones in Northern and Eastern Africa, as well as the Arabian Peninsula and broader Middle East. Indeed, the spring 2015 evacuation of Chinese from Yemen used Djibouti as a drop-off location. On 30 March 2015, PRC Foreign Ministry spokeswoman Hua Chunying acknowledged the country’s reliability, saying “relevant parties in… Djibouti have provided great assistance, to which the Chinese side expresses sincere appreciation.”

Second, if China ever needed to conduct other, possibly more covert types of operations, Obock would be a useful base for this once it includes an airfield capable of accommodating IL-76/Y-20 class aircraft that could move substantial quantities of equipment and personnel. It is located within the un-refueled flight range of an IL-76 taking off from airbases in southern Xinjiang carrying a 40 tonne payload. The large transports can land there, and because it is surrounded by barren desert and separated from the other countries’ Djiboutian bases by the Gulf of Tadjoura, it is reasonably well protected from prying eyes, particularly if aircraft land under the cover of darkness. Access to Djibouti does not mean China can or will conduct these types of missions, but having dependable, high-capacity forward basing access would be an essential pre-requisite for Chinese special operations in Africa and the Arabian Peninsula, should such contingencies ever arise.

Should Outside Observers Be Surprised by Greater Chinese Military Access to Djibouti?

In a word, no. Evidence points increasingly to a more permanent PLAN presence in the country. China and Djibouti both have powerful strategic motivations for deepening their relationship to include a more permanent Chinese military presence in the country.

For its part, the Djiboutian government has become a virtual “basing rentier state.” The country’s economy is tiny, generating approximately US$1.6 billion in GDP for 2014. As such, the total economic output generated by French, U.S., and Japanese military facilities (through rentals, local procurement, etc.) offers an enormous boost to the country’s formerly port and service-based economic structure. Under these conditions, a Chinese naval facility, particularly one that comes with major construction investment, facility improvements, and financial sweeteners, is almost irresistible because it would be another large shot in the arm for the local economy.

A greater and more formalized Chinese presence also offers useful political and diplomatic diversification to Djibouti’s leader. Guelleh will be less beholden to U.S. and French political and military influence if he has the option of playing the Chinese card during tough negotiations or situations. It also boosts Guelleh’s prestige by allowing him to claim that he hosts bases by the two largest economies on earth, as well as two other G7 countries. Moreover, the diverse foreign military presence offers a superb insurance policy to Djibouti, which inhabits a tough neighborhood whose security tectonics can rapidly shift, as we have seen in the past year with Saudi Arabia and Iran fighting a proxy war in Yemen. Few parties—state or non-state—wish to infringe upon a country which is important to the national interests of both the U.S. and China. Allowing China quasi-basing access hammers that point home with the stroke of a pen, the pouring of some concrete, and the docking of a PLAN ship or two in Obock.

Finally, the Chinese military has filled the last decade with hardware and posture developments that surprised many external analysts and materially improved the country’s military capability. The emergence of the Yuan-class submarine, the J-20 fighter, the J-31 fighter, the anti-ship ballistic missile (ASBM), and the decision to engage in South China Sea land reclamation operations offer illuminating examples. Given the magnitude of the aforementioned developments, gaining more permanent access to facilities in Djibouti capable of supporting forward-operating military forces would not be a surprise at all. And in the wake of the data and insights collated by this analysis, it should not be a surprise.

What To Expect Moving Forward From China’s Presence in Djibouti

China has found its forward-deployed anti-piracy force incredibly useful. Besides suppressing piracy, it has rescued Chinese non-combatants from Libya and Yemen and helped escort multiple shipments of Syrian chemical weapons headed to be destroyed. It has also been a great opportunity to show the flag, exert influence, and allow legions of sailors to gain real operational experience.

Alas for China, the time in which it can use the Somali pirate threat as a cloak for forward deploying naval forces is likely coming to a close. As such, Beijing must decide whether it will pull back or instead more openly seek to maintain a permanent military presence in the region. So far, in keeping with China’s overall maritime goals and progress, all the signs point to the latter.

The PLAN’s operating experience to date in the Indian Ocean region highlights the force’s need for robust formal access points. Enhancing forward presence is essential to increasing PLAN deployed presence overseas. Otherwise, even with significant fleet growth, the operational tempo (OPTEMPO) math simply doesn’t work. A forward presence will be essential for safeguarding core Chinese national interests, foremost among the seaborne energy security. China will continue to develop overland pipelines but with limited capacity they likelycannot reduce demand for seaborne crude oil. Pipelines are also highly vulnerable to single-point disruptions and interdiction.

Interposing these factors and viewing them holistically suggests that the PLAN needs long-term, cost-effective IOR presence solution. Emerging IOR overseas access architecture will be an important bellwether of China’s plans for distant operations, and indeed, of its naval strategic intentions more broadly. Access points—including Obock—will probably remain limited in capabilities. Likely to be included: refueling, replenishment, crew rest, low-level maintenance. Less likely to be found at foreign access points: repair, rearmament capabilities.

At this point, the permanent access matters much more than the specific capabilities. A Chinese decision to seek more permanent operational access—and a host country’s decision to grant such access—represent monumental leaps for Chinese diplomatic and military policy. China has for decades proudly proclaimed its lack of military facilities on foreign soil, so seeking long-term military access at a quasi-base level is a massive about face. With long-term PLAN access to Obock likely coming soon, China is poised to cross the rubicon. Djibouti is thereby helping to catalyze a potentially significant symbolic and substantive shift in China’s foreign security policy.

China is not seeking to build a foreign base network capable of supporting high-end naval combat the way the U.S. has. But, for now at least, it need not take that path in order to achieve its strategic goals. More permanently deploying warships, and potentially aircraft, in the Indian Ocean region furthers Chinese diplomacy and geostrategy without firing a shot. Presence and perception matters greatly in this regard. By signing and operationalizing a forces access deal in Djibouti, the PLAN will be laying roots in a vital region that is likely to see sustained, significant growth in Chinese naval activity.

Andrew Erickson and Kevin Bond, “Essay: China’s Island Building Campaign Could Hint toward Further Expansions in Indian Ocean,” USNI News, 17 September 2015.

China’s creation of military-relevant facilities on its newly-created islands in the South China Sea is a cause for concern for countries in Southeast Asia, and several of its investments in the Indian Ocean are raising more questions over the possibility of China’s first dedicated naval support facility overseas.

As China expands its reach into the Indian Ocean and wraps up construction in Southeast Asia, the same sort of assets that built-up the seven Spratly features that China occupies into artificial islands may decamp for ports in the Indian Ocean, potentially strengthening China’s logistics chain for its naval activities in what its strategists term the Far Seas. …

[The] extensive projects [of China Communications Construction Company (CCCC) Tianjin] include the $705 million (US) construction of an underwater tunnel below the Karnaphuli river and port expansion at Chittagong in Bangladesh, the design, construction and maintenance of proposed docks and related structures at Tuas South port in Singapore, a $213 million contract for a crude oil terminal and channel dredging project in Myanmar, as well as the construction of a salt pier in Djibouti. In 2013, CHEC also signed a cooperative agreement on the expansion of the Aden Container Terminal in Yemen before internal instability in the country came to a head.

CCCC is far from the only company operating in the IOR, though, as other Chinese SOEs have further augmented regional investments. CMHI holds 23.5% stake in Port de Djibouti S.A., which includes two-thirds of the port’s Doraleh Container Terminal. Construction of the Damerjog livestock port and the multipurpose Doraleh port, with both projects launching in 2013, are being funded by China Merchants Group. CSCEC won the bid for the engineering, procurement, and construction (EPC) project of Phase I of the Doraleh Wharf in August of 2014, which includes the construction of a 1,200m long frontage for five multi-purpose deep water berths, a 175m long service berth, and related supporting facilities, all in Djibouti.

On land, Chinese companies also opened a new oil pipeline from the Chinese-built Kyaukpyu port in Myanmar to Kunming, Yunnan province, in early 2015. Additionally, CCCC subsidiaries are involved in building educational infrastructure in Djibouti and three highways in Sri Lanka, although a proposed a railroad line in Myanmar between Kyaukpyu and Kunming has been cancelled. …

… President Guelleh acknowledged in an interview in May that China has been engaged with Djibouti in negotiations for a naval “base” in the small African nation, which already hosts American, Japanese, and French forces, saying that Beijing’s presence would be “welcomed.” In February 2014, Chinese General Chang Wanquan and Djibouti’s Minister of Defense signed a security and defense strategic partnership agreement, under which Djibouti is offering itself as a home port for China’s navy, in exchange for rent and military cooperation to strengthen the Djiboutian armed forces’ operational capacities. When asked about negotiations concerning a Chinese military base in Djibouti, China’s Foreign Ministry responded by neither denying nor confirming reports, instead saying that regional stability is beneficial for all countries and China is willing to increase its contributions towards this goal. …

… Now that island construction in the Spratlys appears almost complete for now, many dredgers and related machinery recently engaged there may move to the Indian Ocean, where they can accelerate ongoing port construction projects. Should China seek to establish any official logistics “bases” or other facilities capable of providing naval support, China’s dredging fleet has proven in the South China Sea that it has the horsepower to construct the required infrastructure expeditiously. China has the requisite tools and a firm foundation already set to build the supporting infrastructure for a strong logistics chain in the IOR. The idea of at least one Chinese logistics “base” is appearing more and more to be more a question of when and not if. Keep an eye on Djibouti.

FURTHER ANALYSIS:

Andrew Erickson and Kevin Bond, “Dredging Fleet Shores up Beijing’s Position in South China Sea and Beyond,” Lowy Interpreter, 12 August 2015.

Andrew S. Erickson, “Follow the Dragon Tracks: China’s Emerging Presence From the South China Sea to Facilities Access in the Indian Ocean,” keynote address to Congressional Defense and Foreign Policy Forum, Defense Forum Foundation, Capitol Hill, Washington, DC, 24 July 2015.

Click here to read a full-text transcript of the presentation.

Andrew S. Erickson and Austin M. Strange, Six Years at Sea… and Counting: Gulf of Aden Anti-Piracy and China’s Maritime Commons Presence (Washington, DC:Jamestown Foundation, 2015).

Andrew S. Erickson and Gabriel B. Collins, “Dragon Tracks: Emerging Chinese Access Points in the Indian Ocean Region,” Asia Maritime Transparency Initiative, Center for Strategic and International Studies, 18 June 2015.